Stocks historically outperform inflation

A key point to highlight is that when you invest, you should be investing for the long term. If you have an investment strategy that was put in place with a 10-, 20- or 30-year timeline in mind, short bouts of higher inflation should not drive you to make fundamental changes to your investment. Over the long haul, stocks have historically outperformed inflation. There are however stretches where this has not been the case.

For example, during the 17-year period from 1966–1982, the return of the S&P 500 Index was 6.8% before inflation1, but after adjusting for inflation it was 0%. Additionally, if we look at the period from 2000–2009, the so-called “lost decade,” the return of the S&P 500 Index dropped from -0.9% before inflation to -3.4% after inflation.

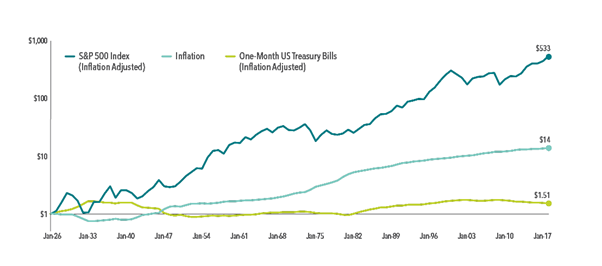

However, if you invested $1 back in 1926 and stayed invested by 2017, this would have equalled a purchasing power of $5002.

Is the current inflation spike cause for concern?

As we emerge from the global lockdown caused by Covid, pent up demand has caused inflation to spike. This release of pent-up demand has exacerbated the supply chain which in turn has caused prices to rise. Expectations currently are that this will be transitory as the biggest sectors to see spike in inflation are used cars, rental cars, lodging, airfares and food away from home according to Bloomberg3. These are all transient in nature and should settle down.

With the future unknown, it is hard to predict whether this increase in inflation will remain high for the foreseeable future or be a short-term blip. Eugene Fama of Dimensional in June 2021 said it well4:

I don’t think anybody predicts the market very well. Market timing is risky in the sense that you’ve always emphasized: You may be out of the stock market at precisely the time when it generates its biggest returns. The nature of the stock market is you get a lot of the return in very short periods of time. So, you basically don’t want to be out for short periods of time, where you may actually be missing a good part of the return.

Although inflation is a concern that we review during our investment committee meetings, one point is clear:

You want to remain invested, remember your strategy is set up for the long term and short-term news should not cause knee jerk reactions to your long-term plan. Missing out on these best performing days can have a serious impact to your return and overall investor experience in the long run.5

Speak to us about financial planning to see how we can create the right solution for your needs. Email wealth@sableinternational.com or give us a call on +27 (0) 21 657 1540 or +44 (0) 20 7759 7519.

1 Source: Dimensional – How does Inflation Impact Investors June 2018

2Source: Dimensional – How does inflation Impact Investors June 2018

3 Source Bloomberg – Fed officials have six reasons to bet inflation spike will pass May 2021

4Source: Dimensional – An Exchange between Eugene Fama & David Booth June 2021

5Source: Dimensional – What happens when you fail at market timing Oct 2019