Modern portfolio theory

Building an investment portfolio that adequately meets each individual investment and risk profile is no easy task. There are a number of different methods to construct a portfolio, but there is one particular methodology has gained popularity.

The core premise of the modern portfolio strategy is the establishment of the “efficient frontier”. The theory suggests that, when constructed correctly, it is possible for a portfolio to offer a maximum level of return for a given level of risk.

As a result, the potential returns offered by any portfolio is determined by the amount of risk which each investor is prepared to take. We feel that this methodology, which research has shown to yield a healthy balance between risk and return, is the optimal portfolio construction strategy and as such, all of our portfolios follow this structure.

Having established the factors of risk that can be combined to form a suitable portfolio - and a means for measuring its risk - we can now step through the process of building a portfolio.

How we construct your portfolio

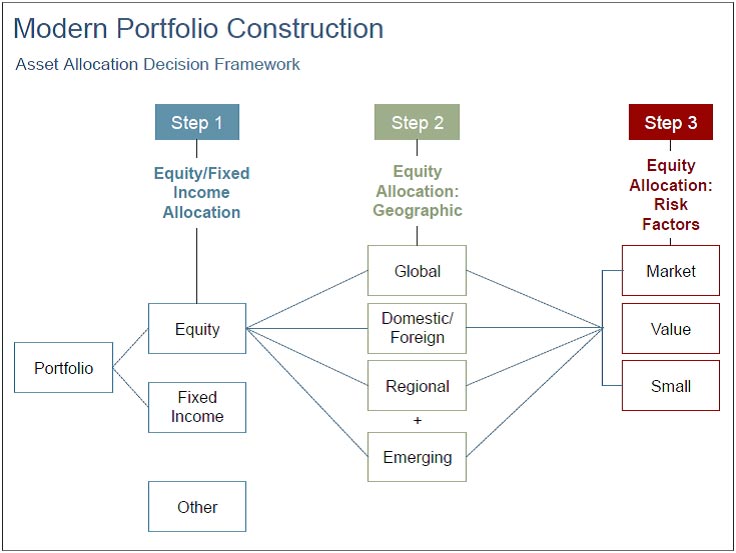

The following diagram illustrates a framework for the construction of portfolios:

Step 1: Determine the basic equity/fixed income split

Our portfolios are gradually allocated increasing amounts of equity from Portfolio 1 to Portfolio 7.

The greater the proportion of equity in a portfolio, the more risk that portfolio will be exposed to.

Step 2: Determine the international equity dimension

The equity component of the portfolios is split proportionally across the developed world, according to the market capitalisation of each country. This helps ensure a well-diversified portfolio and avoids a bias towards any one particular country.

There is also an allocation to emerging markets within the equity component of the portfolios. Emerging market equities have higher levels of risk than developed market equities and, as a result, the expected returns of these equities are higher.

Step 3: Determine the size and value equity dimension

Factors to consider:

- Risk/return: Increasing allocation to small and/or value stocks may increase risk, expected return and tracking error, but may not increase volatility

- Sensitivity to tracking error: Increased sensitivity to prolonged periods of underperformance to the market

Portfolio testing

Our analysis tool gives us access to the longest possible string of returns information, ensuring that we can accurately back-test our models.

When deciding which portfolio is most suitable for your planning needs, it is important that you understand the risk you are taking and the potential for capital loss.

This graph shows what an investment of £100,000 into different risk-rated portfolios would have achieved over the past 25 years.Determination of risk appetite

Using this layered and structured methodology, we are left with a series of investment portfolios with varying levels of risk.

The final step is to determine the risk profile of the investor. There are two core aspects to determine this. The first is the appetite for risk. We ascertain the level of risk an individual is prepared to accept. This is usually established through a questionnaire, specifically designed to probe the investors' risk profile through carefully selected questions.

The second element, and one that is too often overlooked, is the capacity for risk. While the investor may be prepared to expose their investment to heightened risk, in search of greater returns, they may not be in a position to tolerate significant losses.

This element is usually established through a more in-depth discussion surrounding an individual’s financial position, taking into account the stage within their life cycle. As a result, it is very important that these details are discussed with your financial adviser to ensure that all elements of your risk profile are taken into account when creating your investment portfolio.

We provide expert investment advice and services tailored to your personal circumstances

What are investment instruments?

The most conventional investment instruments are shares, bonds and cash. These are the most liquid and transparent asset classes which, in many cases, offer investors a real stream of income, giving them a tangible and genuine value.

Investment instruments that have no prospect of paying an income, such as gold, are speculative. The value of the asset is entirely reliant on finding a counterparty to a trade. A speculator might own all the gold in the world, but it is worthless if he cannot find a buyer.

While there is place for speculation at the fringes of an investment portfolio, we don't believe that speculative instruments should play a major role; our advisers concentrate on cash, bonds and equities.

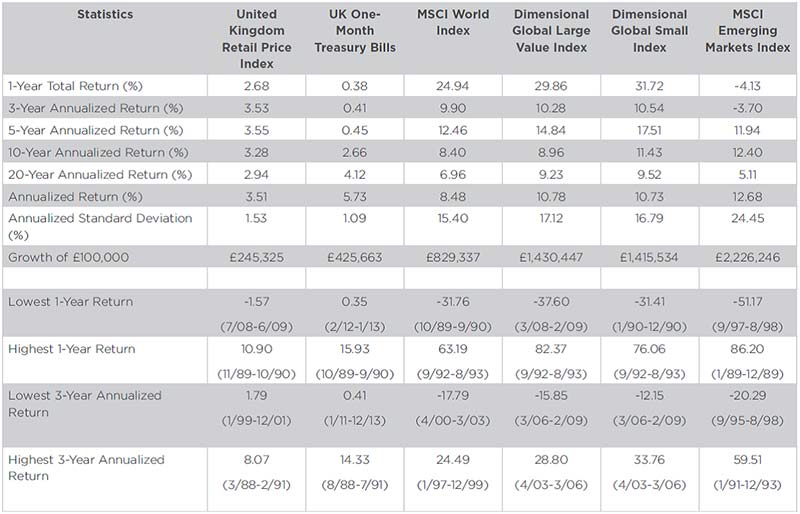

This table shows what an investment of £100,000 in different asset classes would have achieved over the past 25 years:

Equities

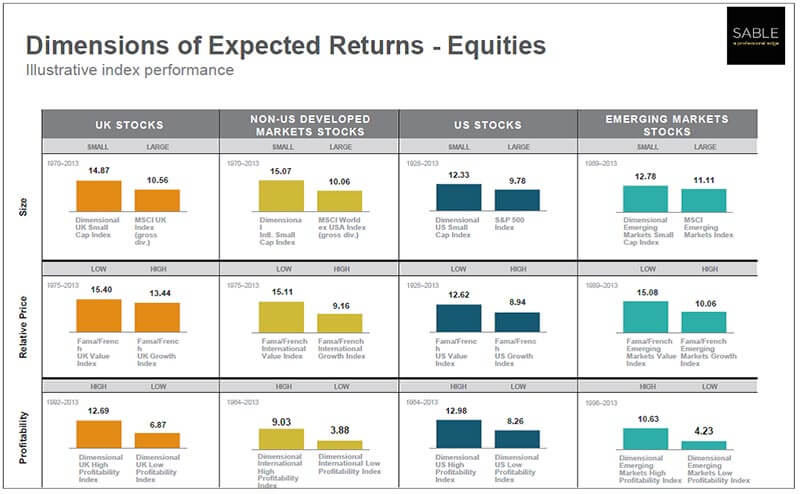

In order to get the best possible equity market return, we focus on exposing our clients to the dimensions of higher expected return that various academics have identified, notably Professor Eugene Fama, of the University of Chicago Booth School of Business, and Professor Kenneth French, of the Tuck School of Business, Dartmouth College.

Fama and French's research suggests that smaller and low-priced companies (i.e. companies whose book value of assets is high relative to their market price) perform better than the market average over time.

Because risk and return are related, the higher expected return comes at a price and, as a consequence, investing in these companies is riskier than investing in the whole market. There are periods when these groups of shares underperform the market, but research indicates that these risk premiums have been worth paying over time.

The chart below shows how these risk premiums have rewarded investors in comparison to an investment in the whole market in different countries. Based on this, we tilt our clients’ portfolios towards small and low-priced companies to an extent that is appropriate to the investor and their long-term goals.

This graph shows the higher expected returns offered by small cap stocks and value stocks in the UK, Europe, US and emerging markets:

Bond investments

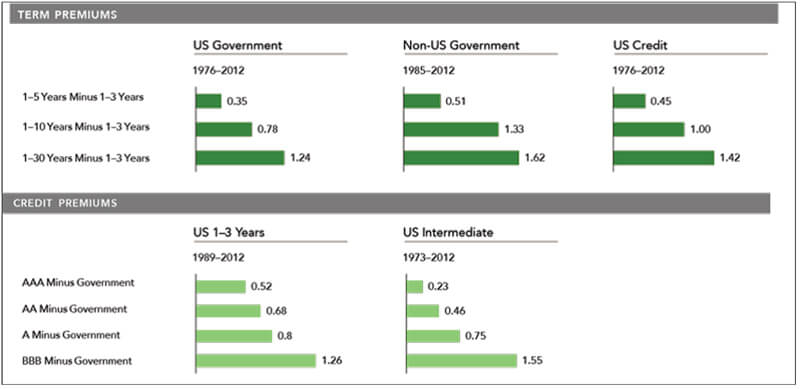

Research also indicates that fixed income, or bond investments, exhibit two risk premiums: Duration and credit-worthiness of the bond issuer.

In principle, longer term bonds and those issued by companies with a lower credit rating are more risky, but pay a higher yield.

Applications of fixed income within a portfolio

Investor Objective

- Lower volatility

- Increase liquidity

- Increase expected return

- Liability matching

- Inflation hedging

Investment Approach

- Short-term, high quality instruments

- Diversification credit exposure and/or term risk

- Targeted duration

- Inflation protected instruments

Property

While property certainly qualifies as a "natural" asset class, we use it sparingly in our clients' portfolios for the following reasons:

- It is a difficult asset class to capture passively.

- Although real estate investment trust funds are available as collective investments - mostly as exchange-traded funds - their structure can be unsuitable for regular premium investors.

- Unlike equity and bond market indices, which are updated based on the daily movement of prices in the market, property indices such as the Investment Property Databank index are only updated quarterly. As a result, it cannot be said that the asset price is derived from an efficient market process.

- Actively managed funds invested directly into property are not always liquid. This can restrict an investor’s ability to redeem funds when asset values are adversely affected by market conditions.

- While not directly related to the dynamics of portfolio construction, many investors already have significant exposure to property in their overall net worth.

We provide expert investment advice and services tailored to your personal circumstances

Hedge funds and absolute returns

During the global financial crisis of 2007 and 2008 a number of hedge funds managed to produce significant returns seemingly at the expense of other investors. Since these events, hedge funds have gained an unfavourable reputation, however they should not be automatically disregarded as an investment strategy.

Many regard them as nothing more than a “black box” of complicated and risky investment structures. In addition to this, the higher fees and minimum investments often deter potential investors, ruling them out when it comes to investment portfolio creation. For these reasons, hedge funds have traditionally only be open to institutional and high-net-worth individuals.

However, this may no longer necessarily be the case. Despite the reputation that they may hold among much of the market, larger retail investment houses are increasingly turning to a form of hedge fund referred to as an “absolute return” fund. The aim of an absolute return fund is to generate stable returns, no matter the market conditions, using a number of strategies which may include the use of derivatives.

In addition to this, unlike a regular long-only asset management or mutual fund, the absolute return fund is unlikely to have a predefined benchmark or mandate. Instead, they attempt to match the return of a number of asset classes. As a result, the nature of these funds are very closely related to the traditional hedge funds.

Core differences in our hedge fund strategy

There are some core differences that should be made clear. These funds have been packaged to distance themselves from the unfavourable reputation that the more aggressive hedge funds tend to have.

They tend to have much lower volatility levels and are designed to lower the overall volatility of an investment portfolio, while offering a marginal element of growth. This is not to say that these funds come without risk, as it follows that the use of derivatives opens the fund to losses, even in an upward sloping market. However, it has been shown that the use of the correct absolute return fund can reduce overall volatility, while dampening the reduction in overall alpha.

We have researched this absolute return marketplace in depth and have a number of options suited to varying levels of risk. Following some discussion and once we have determined your investment objectives, an exploration into this space could serve as justification for allocation toward an absolute return fund.

We provide expert investment advice and services tailored to your personal circumstances

Alternative investments

Traditionally investors look toward three core asset types, namely equity (as in shares traded on exchange), bond and fixed income/interest, or cash. These three asset classes tend to dominate the majority of investor portfolios for a number of reasons, such as liquidity, lower minimum investments requirements, transparency and wider availability.

A well-constructed portfolio containing a combination of just these three elements has proven time and time again to serve as more than adequate to achieve investment objectives. However, this is far from the exhaustive list of possible investment options available to investors.

There are alternative investments that, although less well understood or utilised, still have a place within an overall investment selection. The list of alternative investments is by no means definitive, but it tends to include, among others, art, wine, antiques, coins, stamps, precious metals and other commodities.

The benefit of such investments is that not only do they hold capital value, but there is also a tangible element which appeals to many investors. Another important factor favouring alternative investments is the low correlation that these have to the more traditional asset classes.

This is due to the fact that the value of these assets is not determined by the same drivers as stocks, bonds and cash. As a result, the negative correlation helps to increase the diversification of the overall investment portfolio. In addition to this, by their very nature these assets tend to price out the majority of investors given the elevated price tag, and they come with very limited tax benefits.

When taking the pros and cons into account, whether alternative investments are relevant to your portfolio or not should be determined on a case-by-case basis. However, in order to undertake this, the investor should have a clear understanding of these investments, and they should be discussed with your financial advisor.