We specialise in sourcing and structuring solutions:

Such as:

- Sourcing mortgages for those with unique and unusual requirements - whether you live in the UK or abroad.

- If you're an expat, we can structure your individual finances to make full use of your mobility. Here we'd use the UK's very favourable non domicile tax status or future non-resident planning.

- If you have a limited company, we can optimise the way in which income is paid out and retained earnings are released.

- If you're moving back to your home country, we can structure your assets - particularly if you intend to leave savings or investments in the UK.

Let us help you to:

- Optimise your earnings through tax reduction.

- Maximise various tax breaks and allowances.

- Tailor a low-cost, diversified investment portfolio around your specific needs. This would incorporate a diversified set of asset classes like equity, bonds, property, hedge funds, commodities, etc.

- Assess your individual insurance cover needs, taking into consideration cost, flexibility and mobility.

- Create a full financial plan that covers your short-, medium- and long-term requirements.

In particular, our financial planning services

cover the following areas:

Investment management

Retirement planning

Offshore saving and investment management

Inheritance Tax planning

Migration planning

Tax planning

Elements of financial planning

We take a comprehensive approach to building a financial plan and take into account your current and future circumstances. These are a few of the elements we consider essential for effective financial planning.

Investment management

Investing your money is an important aspect of any financial planning process. However, it can be a daunting prospect, particularly if you have limited experience.

Managing investments requires a detailed understanding of portfolio theory, economics and tools of the trade such as funds and investment platforms. The construction and ongoing management of a portfolio requires significant time investments in research and analysis.

At Sable International, we have taken the time to investigate and construct investment portfolios suited to all levels of risk and investment time horizons. As a result of this, we have the capacity to take the burden of the investment management process away from you, offering you peace of mind that your wealth will be managed effectively.

Mortgage advice and debt management

We have a team of fully qualified and experienced mortgage advisors, covering both simple and complex mortgage cases. Having a mortgage advisor who has in-depth knowledge of your overall financial position presents a unique service offering.

In addition to this, our mortgage advisors cover "whole of market". As a result, each mortgage case is researched on an individual basis to ensure not only the best price, but also that the type of mortgage is best suited to individual circumstances.

Estate planning

Leaving your wealth to loved ones is one of the greatest lasting legacies to provide. Inheritance Tax (IHT) rules consider all wealth over the nil rate band of £325,000 to be taxable at 40%. However, as certified financial advisors, we consider IHT to be an avoidable tax where proper financial planning tools are in place.

We are able to assist with this process through a number of tax-efficient vehicles and investment structures. These can include tax-privileged investments such as Business Property Relief, Venture Capital Trusts and Enterprise Investment Schemes.

Further to this, our in-house solicitor can ensure that your will correctly reflects your current wishes and takes into account the relevant IHT planning implications.

Investment advice tailored to your personal circumstances

Onshore versus offshore investment

When it comes to choosing an investment, it has been well documented that there is a strong bias toward domestic stocks. More specifically, both individual and institutional investors tend to show preference toward the local equity market when constructing their portfolio.

The topic has been researched by a number of well-respected academics and investment professionals[1], and is a factor that many investors overlook. The term putting “all your eggs in one basket” comes to mind. Investors could significantly reduce their risk exposure if they held a portion of their asset portfolio in foreign stocks.

In addition to this, there is the risk that the domestic market underperforms resulting in below par investment performance. Academics have proposed a number of reasons for this bias to become prevalent, but no matter the origins, failure to diversify abroad places the investment portfolio at risk of heavy drawdowns through limited diversification from local market risks.

Home bias and international diversification

Studies have shown that, over the long term, equity markets tend to outperform many other asset classes and, although the investor must tolerate an elevated level of risk, equities remain a core component of both private and institutional investor portfolios.

The investment decision with regards to share choice is an entire industry within itself. However, one aspect which most astute investors will be aware of is diversification. The major benefit of diversification is that it reduces portfolio risk by decreasing exposure to any single element. In addition to this, research[2]has shown that there are significant added benefits to international diversification.

Failure to diversify across international markets is often referred to as “home” or “domestic” bias. Many investors fall victim to this bias because of the ease of access to information regarding local firms, their own inexperience and anxiety with regards to offshore investment and the potential tax or cost implications which may arise. Many of these biases and concerns may be unwarranted, and they conceal the reality that investing solely within domestic equities presents a significant opportunity cost.

The chart below depicts the world not according to land mass, but by the size of each country’s stock market relative to the world’s total market value. While the US is by far the largest market, it is interesting to note the wide dispersion following that. China, Japan, Germany, France and the UK, which make up the next five biggest economies (as measured by GDP and according to the World Bank), make up a combined share of just 22% of market caps.

The implications here are significant as the domestic investor in developed financial centres such as South Africa, or even Spain and India, are exposed to just a fraction of the global equity market, heightening local market risk, while limiting exposure to offshore gains.

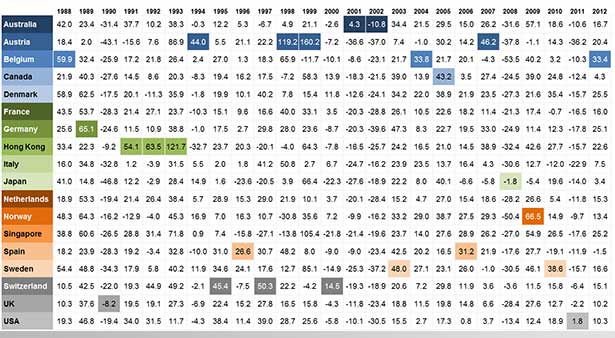

With this knowledge in hand, the prudent investor may make an effort to diversify across international markets. However, the question remains as to where exactly they should place their money. The chart below shows annual equity returns of developed markets. Interestingly, the US outperforms its peers on just one occasion. Thus market size is perhaps not the best indicator of where to invest.

It is clear from the data that there are significant benefits to investing outside of your domestic market, but as it is near impossible to determine which market will deliver optimal returns, it makes sense to diversify across as many countries as possible. This will expose your investment to the largest and most developed capital markets, while elevating your risk-adjusted return.

This is easier said than done, and opening your portfolio to international markets may seem like a daunting prospect. However, this need not be the case. Sable International's investment portfolios are, by construction, heavily diversified across global financial markets. Furthermore, given the nature of the funds in which they have been invested, costs have been kept to a minimum. As a result, by moving your portfolio over to us, you will enjoy all the benefits of an internationally diversified portfolio at a cost likely to be lower than a domestically invested fund.

Use of trusts

Trusts, perhaps incorrectly, have a reputation as predominantly playing a part within the tax and financial planning process through the ability to settle property out of estate.

While this remains a core functional benefit of a trust, it is by no means exhaustive. Increasingly trust structures have the ability to offer a number of unique and interesting roles within the overall financial plan, and can assist in overall wealth creation.

The legal structure of a trust means that they are independent entities, separate from both those providing the funds (the settlor), those who are the intended beneficiaries as well as the entity that manages the investment (the trustee). As a result of this, the tax treatment can offer significant individual and family benefit, but can also become incredibly complicated. As a result, it is imperative that the correct financial advice is sought.

There is no one-trust solution for all, and each individual situation must be examined on a case-by-case basis. Following an in-depth fact find and discussion surrounding long-term investment objectives and the current and future tax situation, we will be able to advise the most relevant and cost-effective trust structure for your goals.

Investing from abroad

Investing solely within your home country heightens the concentration risk on the portfolio, as your assets will be exposed to a single market. This phenomenon is commonly referred to as “home bias”, and it is important that you attempt to diversify your portfolio not only across sectors, but across geographical regions.

However, this is easier said than done, as there are a number of important factors which must be taken into account including tax declarations, capital restrictions and, ultimately, the investment structure.

Given the nature of our client base, we have a wealth of experience within this space as well as the ability to service every aspect of the process. This includes the facilitation of capital migration from one country to another, the establishment of a tax efficient investment structure as well as ongoing investment advice and management.

We have well-established relationships with a number of providers who are able to service clients investing from abroad and understand the concerns related to this type of investment, and we are well positioned for such a proposition. In addition, our investment platform offers both UK mainland and offshore (Jersey) account options for non-resident investors.

Investment advice tailored to your personal circumstances

Understanding tax wrappers

Wrap accounts are an investment structure that help to manage investment portfolios, allowing for consolidation of investments and efficient tax management.

The structure of most wrap accounts allows for investments into all traditional investment types including cash, bonds and shares, unit trusts and pension funds. These account structures can also bring together various tax wrappers such as Individual Savings Accounts (ISA), General Investment Accounts (GIA) and Self-Invested Personal Pensions (SIPP), which ultimately assists in the management of your personal tax bill.

The services that these wrap account providers offer are very similar in nature, but the issue of cost always needs to be taken into account. Here at Sable International, we have working relationships with the leading platform and wrap account providers in the UK and are able to offer each individual the solution that will work best under their unique circumstances.

There are a number of different tax wrappers that the investor can utilise in order to better manage their investment.

These include:

- Pension wrappers

- ISA wrappers

- GIA wrappers

Pension wrapper

Pensions are currently one of the most tax efficient ways to invest for the long term and should be used to their full extent. Although, on the downside, your funds are tied up until you retire, it is often more advantageous to take advantage of the tax concessions these investments offer.

The principal benefits and conditions of a personal pension are as follows:

- The funds in which contributions are invested benefit from tax advantaged growth.

Income from rents, deposits and gilts remains free of tax, as do capital gains. - You can contribute a maximum of £40,000 per annum into a pension.

The amount being contributed into the pension enjoys income tax relief at your highest marginal rate. - Employees and the self-employed are entitled to make payments net of basic rate tax.

A separate personal assessment will make a higher rate tax relief available to these individuals. - Employers, including 100% owned limited companies, are also able to make a direct contribution.

Such payments must be paid gross but are relievable for corporation tax and not accountable for National Insurance contributions. - Pension benefits can be drawn on retirement at any time from age 55.

We expect this retirement age to increase over time to reflect upward movements in the State Pension age. - At retirement, 25% of the accumulated fund can be taken as a tax-free cash sum.

The balance providing a pension taxed as earned income. As of April 2015, the balance of the fund can be taken as a lump sum but subject to your marginal tax rate at the time. - In the event of death occurring before the selected retirement date.

The accumulated fund can be passed to your chosen beneficiaries, completely free of Inheritance Tax, by means of either a prior nomination given to the life office or a declaration of trust, depending on the life office's requirements. - If you plan to retire in a country other than the UK this pension can be transferred without any tax charge to your destination country through the QROPS system.

ISA Wrapper

ISA stands for Individual Savings Account. As a UK tax resident you are able to invest your after tax earnings into the account. There is an annual cap on the amount that can be invested into the ISA, which is currently £20,000 per annum.

All gains, income and dividends earned by the investments in the wrapper are tax exempt. As such, an ISA provides tax-free growth on your investments.

An ISA does not have any access restrictions and you can liquidate your investment at any time. You are able to transfer your ISA investments to a different provider and retain the previous allowance limits. This process is called an ISA transfer.

GIA Account

A General Investment Account (GIA) is an investment without an upper limit, although tax is payable on the growth made within this wrapper. The GIA account is used predominantly for those investors who have already invested the maximum annual allowance into their ISA and who are making significant contributions to their personal pension.

Resources

- [1] Jeske, K. (2001) Equity Home Bias; Coval, J. & Moskowitz, T. (2002) Home Bias at Home Local Equity Preference in Domestic Portfolios; Steiman, B. (2008) When Home Bias and Hot Bias Collide

- [2] See: French, Kenneth; Poterba, James (1991). "Investor Diversification and International Equity Markets". American Economic Review

- Tesar, Linda; Werner, Ingrid (1995). "Home Bias and High Turnover". Journal of International Money and Finance

- Coval, J. D.; Moskowitz, T. J. (1999). "Home Bias at Home: Local Equity Preference in Domestic Portfolios". Journal of Finance