Payments Manager

Fund. Convert. Pay. It’s that simple

With Payments Manager, you take control of your international money transfer needs.

Fund your wallet with up to 35 currencies and convert and pay at your convenience.

Global Collections

Of all the challenges businesses face, getting paid shouldn't be one of them.

With Global Collections, collecting international payments is made simple, fast and hassle-free.

It’s now easier for your customers to pay you in their local currency.

How it works:

1. Register

Register for a Currency Solved wallet by completing the basic application form found below. This allows us to assess which of our services will best fit your needs.

2. Verify

Provide the required documentation to verify your business or personal identity.

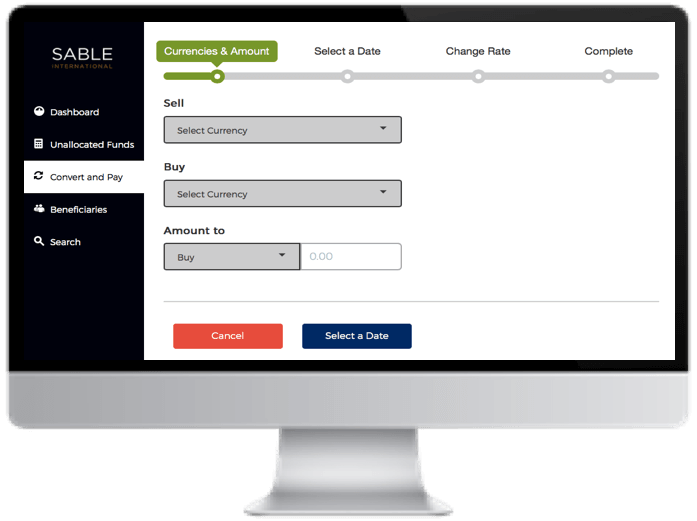

3. The platform

Once our team has processed your application, you’ll have access to your own currency management platform. Usually within one working day.

4. Walkthrough

One of our brokers will contact you and guide you through the platform. We'll answer any questions you may have.

5. Fund

Fund your wallet. Once your wallet is funded, you will have the option to convert and pay in up to 35 currencies globally.

The Currency Solved platform

A simple and easy-to-use platform that removes the complexity around currency conversions.

We provide a logical conversion, payments and receipts process with full trade visibility that administers international money transfers in line with global compliance standards.

Corporate wallet holders can assign user roles with a variety of security permissions.

*For clients based in the United States of America, Canada and Europe (EEA), payment services are provided by The Currencycloud Ltd. Where applicable, UK-based individuals and corporate clients may opt to use this payment service.

Register now

Take your forex to the next level

How you benefit with Currency Solved

It’s the cost-effective way to manage your global currency requirements all in one place.

Currency Solved gives you access to live exchange rates as well as global currency receipts and payouts.

No hidden costs. Fantastic service.

Live currency conversions

Convert your currency at competitive exchange rates priced off the live currency markets. You can secure exchange rates 24 hours a day, five days a week.

Global payments

Global payments functionality gives you choice and control over your local and international payments. Local payouts are far more cost-effective and we offer domestic payouts to over 35 countries.

Global receipts

We help you get paid faster. Buyers can pay invoices locally, in their own currency, rather than with international transfers. The money is available quickly and can be converted before being paid back into your bank account at home.

DIY or broker assistance

You can book trades yourself using the interactive conversions and payments platform or have one of our brokers secure your exchange rate over the phone.

Take your forex to the next level

Who is Currency Solved for?

Importers and wholesalers

- Convert when favourable and hold balance to sustain future payments/invoices

- Local payment means zero sending fees

- Easily manage and validate multiple beneficiaries

Exporters

Simplify your buyers’ payments and control the conversion thereof. Seamless payment and receipt, with added revenue.

- American and European buyers settle locally in USD and EURO

- Foreign currency can be held unchanged and used to offset future payments

Travel and tourism industry

- Clients benefit from convenient payment into local USD and EURO accounts

- Reduces the need for card payments with heavy fees and commission payments to merchants

- Foreign currency can be held, unchanged and used to settle service provider invoices

How does the relationship between Sable International and Currencycloud work?

Key aspects

- Sable International owns the relationship with you and are responsible for providing you with ongoing help and support.

- Currencycloud is an authorised financial services entity ultimately providing regulated payments and e-money services to you via their technology, platform and payments network. This enables us to provide a seamless service to you.

- Currencycloud is responsible for regulatory compliance regarding the provision of regulated payments and e-money services to you under this agreement.

For clients utilising our Currency Solved service these products and services are provided by the FCA regulated E-money institution Currencycloud:

For clients based in the European Economic Area, payment services for Sable International FX Limited are provided by Currencycloud B.V. Registered in the Netherlands No. 72186178. Registered Office: Nieuwezijds Voorburgwal 296 - 298, Mindspace Nieuwezijds Office 001 Amsterdam. Currencycloud B.V. is authorised by the DNB under the Wet op het financieel toezicht to carry out the business of an electronic-money institution (Relation Number: R142701).

For clients based in the United States, payment services for Sable International FX Limited are provided by The Currencycloud Inc. which operates in partnership with Community Federal Savings Bank (CFSB) to facilitate payments in all 50 states in the US. CFSB is registered with the Federal Deposit Insurance Corporation (FDIC Certificate# 57129). The Currencycloud Inc is registered with FinCEN and authorised in 39 states to transmit money (MSB Registration Number: 31000206794359). Registered Office: 104 5th Avenue, 20th Floor, New York, NY 10011.

For clients based in the United Kingdom and rest of the world, who choose to use Sable International FX Limited’s Currency Solved Service, the payment services are provided by The Currencycloud Limited. Registered in England and Wales No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currencycloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199).

For clients utilising our Currency Solved service, when funds are posted to your account, e-money is issued in exchange for these funds by an electronic money institution who we work with (Currencycloud). In line with regulatory requirements, Currencycloud safeguards your funds. This means that the money behind the balance you see in your account is held at a reputable bank, and most importantly, is protected for you in the event of Currencycloud’s, or our, insolvency. Currencycloud stops safeguarding your funds when the money has been paid out of your account to your beneficiary’s account.

Please see terms of use here