The changes

Generally, people with a living annuity are only entitled to change their withdrawal rate once a year on the anniversary date of the policy and are limited to withdrawals at the lowest limit of 2.5% of the capital amount and at an upper limit of 17.5%. On a capital amount of R10 million, this would equate to an upper annual withdrawal limit of R1.75 million and a lower limit of R250,000.

This means that you are locked into a fixed amount for the whole year, even though your circumstances may have changed. For example, having other sources of income dry up or facing a sharp increase in living costs. The South African government has announced a few temporary changes to ease cash flow:

- You are now permitted to change your drawdown at any time between 1 June and 30 September 2020 (irrespective of whether the contract's anniversary date falls within the period)

- The lower withdrawal limit was set at 2.5% of the capital amount, but is now being lowered to 0.5%

- The upper annual withdrawal limit was set at 17.5% of the capital amount, but is now being raised to 20% to allow policy holders to withdraw a greater amount

- Any elections made during this period will be applicable for the four-month period only

The importance of offshore exposure

With the looming temporary changes to living annuities, now is a good time to look at your current provisions and consider your options.

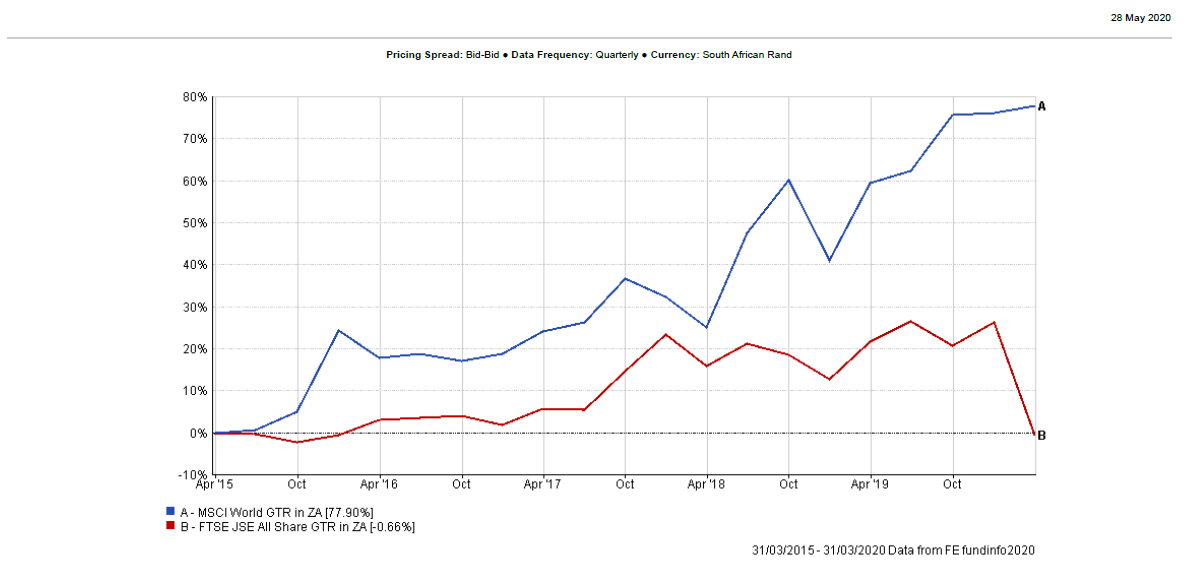

Over the past 90 years (the very long term), South African and global equities have provided similar Rand returns of around 7.5% above inflation. However, over the last five years, global equity returns have significantly outperformed South African equities.

Many South African investors are familiar with Regulation 28, which limits equity exposure to 75% of a portfolio. In addition, there is a maximum limit of 30% in offshore assets and an additional 10% for the rest of Africa. These rules were initially created to protect investors from unregulated offshore investment schemes and ensure that future Rand liabilities are matched to Rand investment income.

However, what many people don’t realise is that Regulation 28 applies to retirement annuities, pension and provident funds only. Living annuities are not subject to Regulation 28 as they fall under the Insurance Act. The current rules of living annuities allow investors to invest where they wish across all asset types. As we are an SA- and UK-licensed firm, we've been able to create an offshore living annuity that allows 100% of the funds to be externalised in offshore portfolios designed for your specific needs.

While there’s no guarantee that investing offshore will outperform local markets, investing out of the country is considered key when it comes to a balanced financial portfolio. Currently, South Africa only represents an estimated 1% of the global financial market, which essentially means that with only being invested locally you are giving up on 99% of the global market opportunity.

The temporary changes to living annuity drawdowns present an opportunity to diversify your portfolio.

Options for South African residents

A South African resident wanting to hold international discretionary funds is able to do so, however there are a number of challenges. If self-selecting, the person would need to select funds from a huge offshore universe of funds. The research and due diligence challenge this presents is significant. If the person approaches an advisor, the advisor will be limited to South African-registered offshore funds.

This is a very limited universe of funds that doesn’t represent the full investment opportunity of offshore investing. Even after such a portfolio has been constructed, this offshore portfolio will present tax filing challenges in South Africa. Should such a person select a portfolio of foreign stocks, they would need to consider the situs tax issues related to holding foreign equities and the lack of diversification within such a solution.

Arranging flexible and tax-efficient savings vehicles, such as international retirement plans, has specific advantages for a South African. You can make one-off or ad-hoc contributions with cash or existing offshore assets. As a pension, it can be accessed from age 50 as either a lump sum or an income stream without the need to purchase an annuity.

There is no tax on interest or capital gains before benefits are taken and it can be structured to be passed to your beneficiaries in an efficient manner and without incurring exec fees.

Now is the perfect time to discuss your options for anyone looking to externalise their investments. The offshore investment arena provides increased opportunity, since investors can invest in various countries, products and industries. The opportunities range from foreign currency fixed-period bank deposits, foreign government and corporate bonds to shares on different stock markets and foreign venture capital. This spread will give a balanced exposure to different risks and returns.