Value stock vs growth stock

A value stock is simply a stock that is currently undervalued relative to its fundamentals. The most common measure is using either price-to-book or price-to-earnings. You are therefore comparing a company’s stock price potentially against their earnings, sales, book value or cash flow.

Growth stocks, in comparison, are companies that have rapidly growing revenue, earnings and cashflow.

Here at Sable International, we have been tilting our portfolios to value stocks since 2014 as part of our investment strategy to focus on global diversification with an overweight position to value stocks, small cap stocks and stocks with above average profitability. This strategy is backed by years of academic research that shows these additional premiums, when combined with a globally diversified portfolio, can enhance your returns.

The historical precedent

In recent years, growth stocks have outperformed value stocks, which shows a departure from long-term averages.

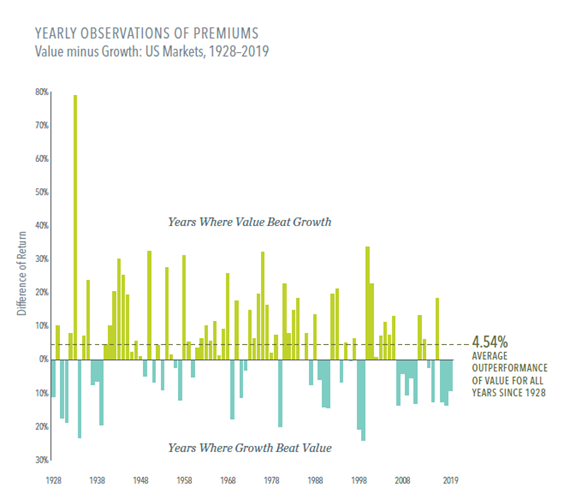

Here is a great graph from Dimensional, demonstrating the annual returns of value and growth since 1928:

“Data covering nearly a century backs up the notion that value stocks – those with lower relative prices – have higher expected returns. On average, they have outperformed growth stocks by 4.54% annually since 1928.

While there's no way to know where stocks are going next, value has trailed growth in the past before rebounding strongly. Logic and history argue for a commitment to value stocks, so investors can be positioned to take part when those shares outperform in future.”1(It is important to note that past performance is no guarantee of future results.)

The value of the long-term view

David Booth, who is the Executive Chairman and Founder at Dimensional, explained why this may have happened: Too often news headlines can distract us from taking the long view when investing.2Over the past decade, growth has significantly outperformed its historical average (16.3% vs 9.7%). Value, on the other hand, performed similarly to how it has historically behaved. Therefore, growth has been the outlier and performed better than expected. When looking at the financial science, it suggests we should enjoy these periods of unexpectedly good returns but not count on them repeating.

You may ask: But why has there been an unusually long period of years where growth has beaten value? One reason is interest rates. When interest rates are low, investors favour companies with good cashflows, which is exactly what growth companies have.

When interest rates fall, the lower risk-free rate results in a higher present value for future cashflows. Therefore if rates start to rise, even by a small margin, it can swing the table back in value’s favour.

Another answer is human behaviour. When things are working and during periods when growth stocks are outperforming, many investors will keep piling into those stocks. We, however, prefer to think about investing over the long-term, using long data sets when making our investment decisions.

With interest rates being low for the last decade, it has been a rough ride for value holders as shown in the graph below:

This swung dramatically the other way in 2020, where we have seen a resurgence in value stock growth. By continuing to take the long-term view, our clients that remained invested in value were rewarded over the last year:

No one can predict where the returns will come from and when looking at values performance there have been instances where some of the weakest performance has been followed by the strongest. These gains can show up quickly, which is why it is important to maintain exposure to value 3 4.

When observing market performance over the last 50 years, time and again we see returns come in spurts. We do not know when those spurts will come and missing them can cost you dearly. That is why getting into and out of markets is such a bad idea. Doing this often is likely to put you on wrong side of your investment decision.

This is why, when we look at value stocks, the rationale for investing in them remain as strong as ever. The less you pay for a stock, the higher your expected return. This is simple algebra.

Rob Berger at Forbes confirmed that since 1926, according to the Bank of America, value has returned an impressive 1,344,600% vs growth stocks returning 626,600% 5. The last 10 years may say otherwise, but for any clients investing for the long-term, history is on the side of value.

Speak to us about financial planning to see how we can create the right solution for your needs. Email wealth@sableinternational.com or give us a call on +27 (0) 21 657 1540 or +44 (0) 20 7759 7519.

1Source: Dimensional – When it’s Value vs Growth July 2020

2Source: Dimensional – Value Investing August 2020

3Source: Dimensional – An exceptional Value premium Oct 2020

4Source: FE Fund Data comparing Dimensional targeted Value against Nasdaq 100, S&P 500 and Morningstar Large Cap indices, April 2020 to April 2021

5Source: Forbes – Do Value stocks really outperform growth stocks in the long run? November 2020