Here’s our guide on how to register for eFiling and initiate a Tax Type Transfer between users, which will give an accountant (tax practitioner) shared access to your eFiling so they can take over doing your taxes.

The changes

As of 17 April 2020, for an accountant to access your tax profile, you must authorise them on the eFiling platform. If you are already registered for eFiling and your details are up to date, this change won’t pose a problem. However, if you have not registered for eFiling, you will need to do so and possibly provide proof of identity before you can authorise your accountant (tax practitioner).

SARS requires three documents to check you are who you say you are:

- A copy of your ID

- Proof of residence (under three months old)

- Proof of a South African bank account (assuming you have one) (under three months old)

If you are trying to register for eFiling from overseas, it’s important to be aware of these requirements so you can plan ahead. While SARS will accept an international proof of residence, you may have trouble receiving the authorisation SMS on an international number and it’s better to select to receive it via email. You may also encounter problems if you no longer have a copy of your South African ID or a South African bank account, or if your details differ from the ones that SARS has on record.

Another positive change is that if you aren’t already a taxpayer, registering on eFiling will now issue you a tax number automatically, saving you from having to go to a SARS office.

How to register for eFiling and set up your account

To register for eFiling, all you must do is go to https://secure.sarsefiling.co.za/app/register and then:

1. Fill in your full name, your ID number and your date of birth.

2. Fill in your mobile number, email address and create a username and password. Please note: The password you use for eFiling must be at least eight characters long, must have at least one uppercase letter, one lowercase letter, one number and one special character (special characters are found along the top row of your keyboard, above the numbers, for example !, @ or #)

3. SARS will send a one-time pin (OTP) through to the email address you provided to ensure that you entered it correctly and that the address belongs to you. Make sure you can access your email during the registration process as the OTP expires after three minutes.

4. You will be logged out and you’ll need to use your new details to log in again. You will then be directed to a welcome page that includes terms and conditions for you to read through and accept.

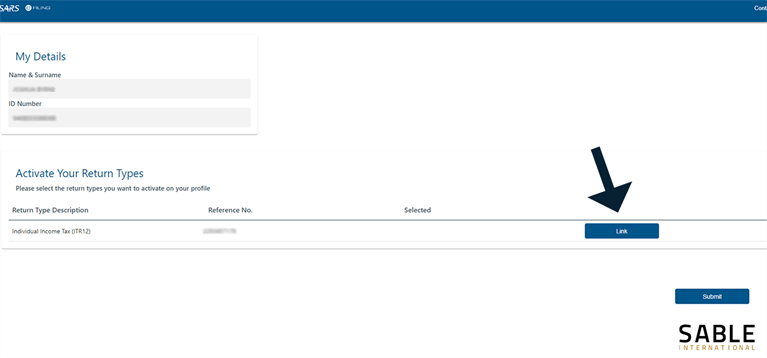

5. After you have accepted the terms and conditions, you will be given access to your eFiling dashboard. Click on “1. To link your own tax type, click here”.

6. This will give you the opportunity to link the tax number associated with your ID number to your eFiling account.

Some users might have to provide proof of identity at this stage, including a copy of your ID, proof of residence (under three months old), proof of a South African bank account (under three months old).

If you don’t have a South African bank account, you will need to upload a letter stating as much.

How to authorize your tax practitioner

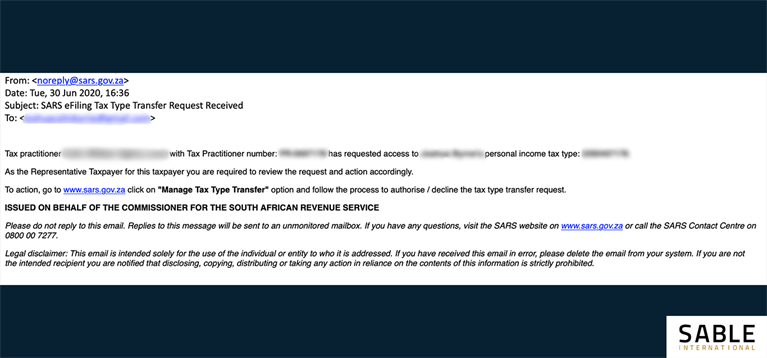

When your tax practitioner requests access to your account, you will receive an email from SARS that looks like this:

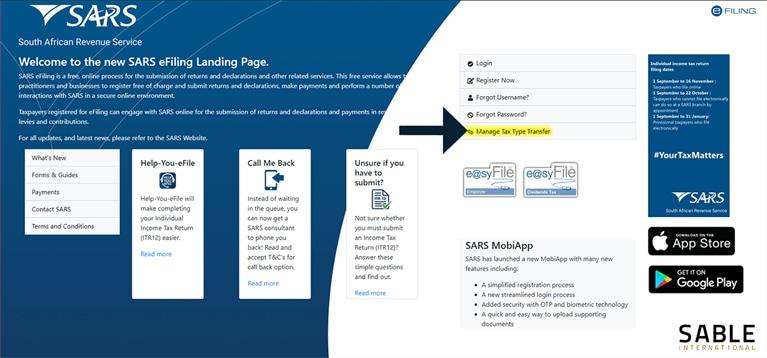

1. Go to www.sarsefiling.co.za and click on Manage Tax Type Transfer. Please note: This button is not on your eFiling dashboard but on the SARS eFiling homepage. Your home page could look like either of these examples.

2. This will take you to a page that asks for your ID number and tax number.

3. Once you have submitted these details, you will need to receive either a text message or an email to approve the request. This is why it was important to set up these contact details on eFiling before initiating a Tax Type Transfer.

4. A one-time pin (OTP) will be sent to your selected channel (either email or mobile). You will need to enter the code to proceed with approving the Tax Type Transfer.

5. After you have entered the pin, you will have five minutes to approve access to your tax transactions. The agreement will look like this:

When you have accepted the above, your Tax Type Transfer is complete and your accountant can access your account.

How to remove your tax practitioner access

1. Log in to eFiling

2. Click on “1. To link your own tax type, click here”.

3. You will be able to view all your return types and will be given the opportunity to remove access.

Before to this change, unethical tax practitioners could hold eFiling accounts to ransom as well as access users’ security details. The adjustment will mean tighter security and put the power over your taxes firmly in your own hands, even if it takes a few more steps to get set up.

How to change your contact details with SARS

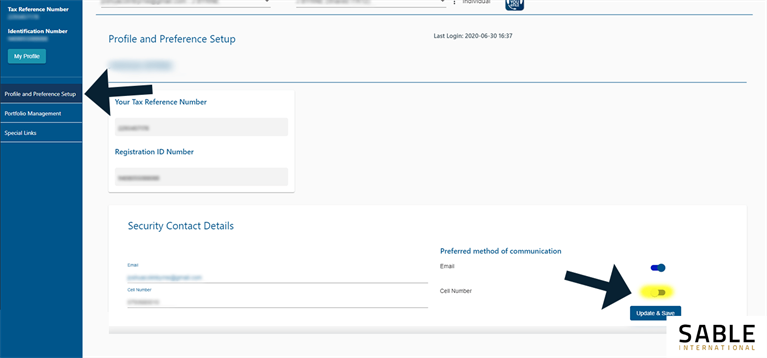

1. From your dashboard, click on the “My Profile” button.

2. Then go down to “Profile and Preference Setup”, which will appear under the “My Profile” button. You may now change your security contact details or select a different preferred method of communication. For example, you might prefer SMS communication to email.

How a tax practitioner can request a Tax Type Transfer

1. To request shared access, a tax practitioner will log into their eFiling profile. They will then click on “Organisations”, then “Request Tax Types” and then click the “Create New” button.

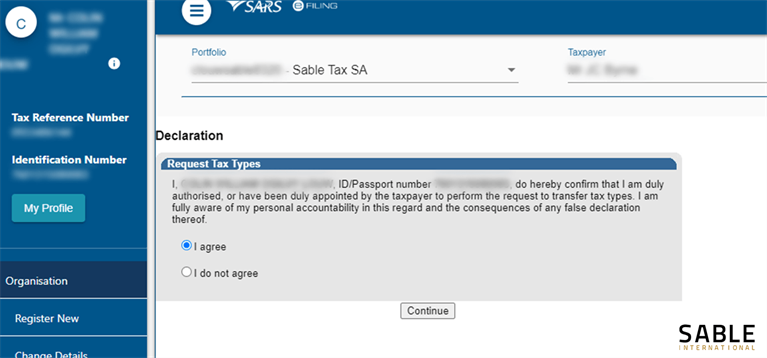

2. They will then be asked to agree that you have the relevant authority to request access.

3. The tax practitioner will then insert the tax number for the tax type to be requested.

4. The tax payer should now receive a request to release the profile as shown earlier in the guide.