In October 2021, legislation changed for non-tax residents intending to claim a living annuity while living abroad. To transfer funds from South Africa to an overseas bank account, an application for a good standing tax clearance certificate must now be made. Previously, all you had to do was show that you had financially emigrated and the fund could make an offshore payment. Now, the process of accessing your living annuity offshore has become more complicated, particularly for elderly non-tax residents and those who have been out of the country for more than ten years.

What is a living annuity?

During your employment years, you would normally contribute to pension funds, provident funds or retirement annuities. These funds get built up over time until you reach retirement age. Once you retire, this fund becomes a living annuity that you can live off for the rest of your life.

With a living annuity you can select an annual annuity income rate between 2.5% to 17.5% of the fund value. This income is paid to you either annually, quarterly, or monthly. If you are living overseas and would like your income sent to you in your country of residence, you need to have an active tax number and eFiling access so you can obtain a certificate of good standing from the South African Revenue Services (SARS). You will also be required to show that you have changed your tax status with SARS by supplying a notice of non-resident tax status and your insurance policy showing the income received.

See also: How to transfer your retirement fund out of South Africa in 2021 and beyond.

Managing your tax compliance status and acquiring a Tax Clearance Certificate

SARS has introduced an enhanced Tax Compliance Status (TCS) system as part of its effort to improve compliance. Printing of the Tax Clearance Certificate (TCC) has been discontinued as of 2 November 2019. The new TCS system allows you to obtain a TCS PIN in real-time, instead of a manual Tax Certificate. The TCS PIN allows any organisation (or government) to view your overall tax compliance online via eFiling.

You can use the TCS system to apply for a letter of good standing by selecting the “tax status” menu option on eFiling.

SARS issues a Tax Clearance Certificate once all of an individual's tax returns are up to date. This showcases good standing and no outstanding tax returns with SARS. A Tax Clearance Certificate of good standing with SARS is valid for a year from the date of issue.

See also: Obtaining a tax clearance certificate of good standing.

Types of tax compliance requests

Tender compliance status

The tender compliance status is issued to support an application for a tender or bid that has been advertised.

Foreign Investment Allowance compliance status

The Foreign Investment Allowance compliance status is issued when a taxpayer will be investing funds outside of South Africa. Foreign Investment Allowance applications are only available to individuals older than 18 years of age. South Africans are allowed to transfer up to R1 million offshore per calendar year without having to obtain a Foreign Tax Clearance Certificate. This amount is covered by your annual single discretionary allowance (SDA). Note however that a non-resident for tax in South Africa is not allowed to use their SDA the year after they change their tax residence.

Emigration compliance status

The emigration compliance status is required when a taxpayer permanently leaves South Africa to reside in another country and can only be selected if the eFiler is registered for income tax. The original purpose of the for this tax clearance is to encash your RA and Preservation Fund after the three year period from when you have tax emigrated.

Good Standing compliance status

The Good Standing compliance status is issued when a taxpayer wants to confirm that their tax affairs are in order with SARS.

See also: Emigrating from South Africa? Here’s your ultimate tax emigration guide.

How to secure a letter of good standing

1. Registering for SARS eFiling

To obtain eFiling access, you have to register online with SARS. SARS must have all your updated details. If you stay overseas, this entails setting up a virtual appointment with SARS to ensure that all your personal information is 100% correct. It takes up to 21 working days for this process to be completed, after which you will be allowed to apply for an eFiling profile.

At this point in the process, SARS will request confirmation of basic personal information to confirm your identity:

- A certified copy of your ID.

- Proof of residence (no older than three months).

- Proof of a South African bank account, should you have one (no older than three months). If you do not have a South African bank account, you will need to provide SARS with a letter stating this.

- An SA cell number is mandatory to register on eFiling.

You will be granted eFiling access after your documents are accepted.

What to do after registering for eFiling

Once eFiling access is granted, it is mandatory for taxpayers earning an annuity income to do tax returns, to make sure you stay in good standing. You have to apply for a good standing certificate every 12 months, which gets given to the bank.

Registering for eFiling and initiating a Tax Type Transfer between users, will give an accountant (tax practitioner) shared access to your eFiling so they can take over doing your taxes. Be aware that SARS may remove your access when you grant full shared access, however you can get your full shared access back again.

Video: How to register with SARS for eFiling.

See also: How to authorise a tax practitioner to do your SA taxes.

Complications South African non-tax residents should be aware of

You should always use your current overseas residential address. Using this, however, could be because SARS requires certain types of documents in English to prove a residential address. This can be challenging if you're in a country where a foreign language is spoken. You will have to get your confirmation of address translated. Something else to take into consideration is that what might be used as proof of address overseas might not be recognised by SARS.

The other thing that SARS requests is a certified copy of your ID. SARS only accepts a stamped certification irrespective of whether it's allowable under law or not. What SARS doesn't recognise is that many other countries do not use stamps. While South African law says that you don't have to use a stamp, SARS internal requirements state that a stamp is necessary. This can be a frustrating process.

We recommend that you do your tax returns going forward so that there is no potential issue with SARS requiring historic tax return submission (even though not required by law) and then levying administrative penalties.

Changing your SARS eFiling security details

If you ever change your email address or general contact details, these must be updated on your eFiling profile. Here is how to update your eFiling profile:

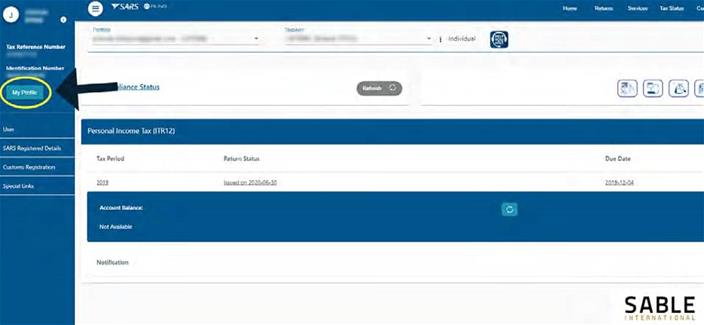

- From your dashboard, click on the "My Profile" button.

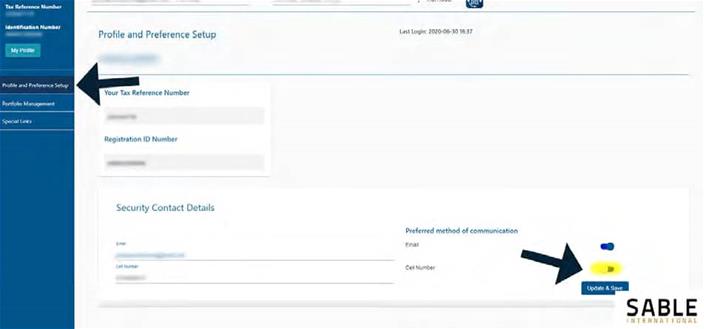

- Then go down to “Profile and Preference Setup” , which will appear under the “My Profile” button. You may now change your security contact details or select a different preferred method of communication.

Request your Tax Compliance Status on SARS eFiling

The letter of good standing only takes between 24 to 48 hours to be processed but you need to know how to apply for it.

Start by logging into eFiling using your existing username and password.

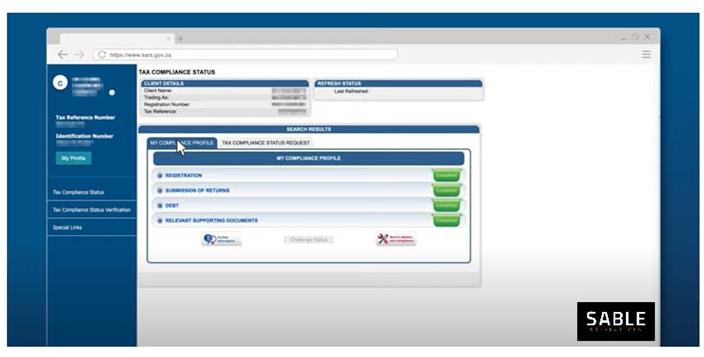

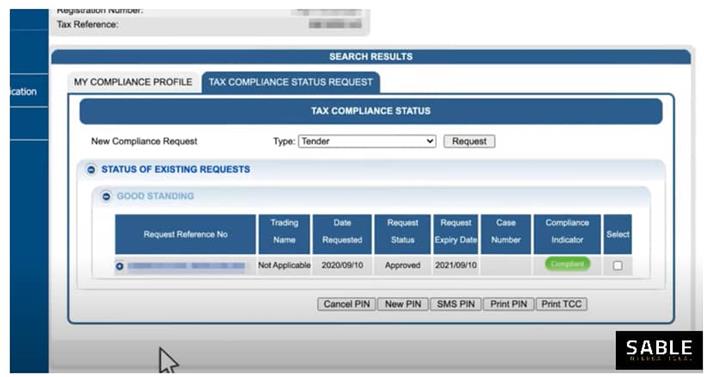

- Select the Tax Compliance Status on the eFiling dashboard landing page. Go to the My Compliance Profile dashboard. This dashboard displays your compliance requirements, the status indicator and the description that reflects the summary status.

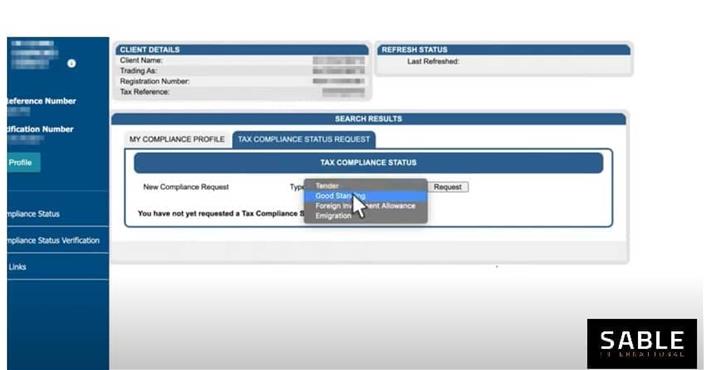

- Click Tax Compliance Status Request. A list of four TCS request types will be displayed in the Type field. Select Good Standing then click Request.

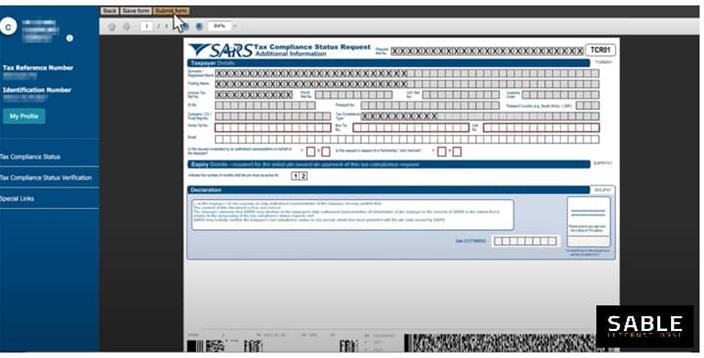

- Complete all mandatory fields on the Good Standing form and select Submit.

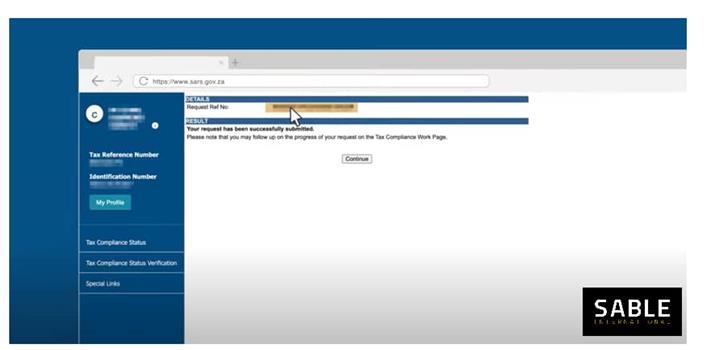

- The results will be displayed indicating the Request Ref No and that your application has been successfully submitted.

- Click Continue. The Tax Compliance Status page will now display your request. If you expand the option, this will display a summary of the TCS request submitted. Click the Request Ref No hyperlink and it will display the Tax Compliance Status work page.

- This is where you will find your TCS PIN which can be shared with a third party like your accountant. Should you request the letter as an option to share, you must log out and in again for the letter to be generated. Once the letter is generated for the PIN, the TCS work page will be updated and you can click on the View link to open it.

Video: How to request your Tax Compliance Status on SARS eFiling, SARS video

Obtaining a Tax Clearance Certificate of good standing from SARS in order to access living annuity funds paid from South Africa to an overseas bank account is imperative. Currently, we believe that this is only affecting people where the banks are aware that they reside outside of South Africa.

Need help accessing your living annuities? Our South African tax team provides comprehensive services and advice for both South Africans at home and abroad. Get in touch with us at taxsa@sableinternational.com or give us a call on +44 (0) 20 7759 7560 (UK) or +27 (0) 21 657 1517 (South Africa).