This article was originally published on BizNews

When you emigrate, you will want to ensure the South African Revenue Service (SARS) stops seeing you as a South African tax resident, so you no longer have to pay SA tax or submit SA tax returns unless you're earning income in SA from an SA source.

This tax status change, known as “tax emigration”, is reported to SARS in the tax return covering the period you left South Africa. Your tax charges will apply retroactively and can vary significantly depending on how much of the tax year you were out of the country.

Income tax and emigration

Under South African tax law, your monthly income tax is based on the assumption that you will work the full year at the same salary. At the end of the tax year, any tax that you were overcharged for is returned to you in a refund. For example, if you had months when you were unemployed, or no longer working in South Africa.

This means that if you emigrate late in the tax year, you will get a minimal refund for the months you didn't work. However, if you leave early in the tax year and only have a few months' salary over the full tax year, you can claim a much larger refund.

While a large refund never goes amiss, the amount you earn for the year also determines your tax bracket, which has a wider impact on other tax charges.

How Capital Gains Tax is affected

When you change your tax status, you're deemed to have sold your worldwide assets from your local self to your foreign self on the day you left South Africa. This triggers a capital gains tax (CGT) event, which is sometimes called “exit tax”.

CGT is a tax on the profit you make from selling an asset. The difference between South African capital gains tax and many other tax jurisdictions is that in those jurisdictions the CGT is a flat rate with certain exemptions. In SA, a portion of your capital gain gets added to your other income for that year and this portion varies from 7.2% to 18% depending on what tax bracket you're in.

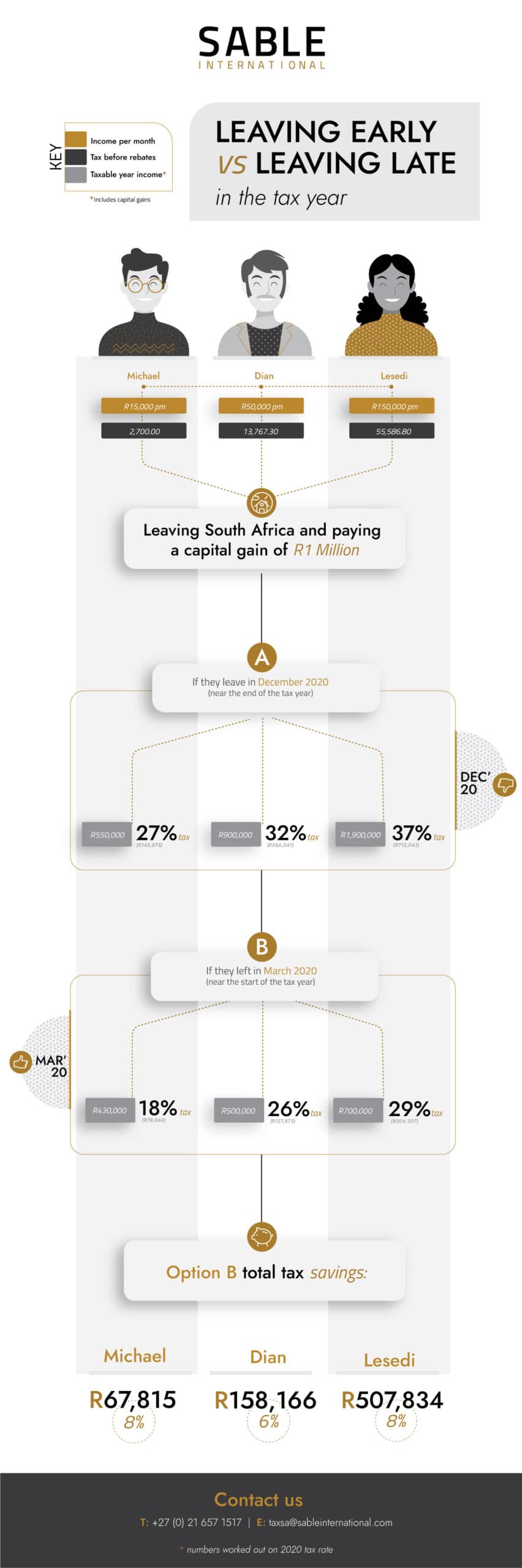

The graphic below illustrates how it makes sense for you to leave early in the tax year to make sure you're in the lowest possible tax bracket. The more you earn, the greater impact a few extra months in SA during the tax year can have.

South African property is also always subject to CGT when you sell it, regardless of whether or not you're a South African tax resident at the time. This is worth bearing in mind if you plan to sell a property in the same tax year that you leave South Africa, as you could end up paying CGT on all your assets together. However, if you sell in the next (or prior) year, you will then add the gain to the taxable income of that year instead.

The primary residence exclusion

Your home, or the place you reside in for most of the year with your family, is exempt from CGT up to a R2 million threshold. But what if you sell your home after you leave the country? Can it still be considered your primary residence if you're not living there anymore?

Many South Africans aren't aware that there is a special allowance for taxpayers who move locations and are still trying to sell their old home who can show that they were trying to sell their primary residence before they left. If you put your home on the market before you go, it can still be considered your primary residence for two years, even if you're renting it out, so long as it remains on the market.

To make use of this exemption and save on your tax, you must not start renting out the property before you leave the country as it will no longer be considered your primary residence. This means you will only receive a portion of the R2 million exemption for when it was your primary residence when the CGT event triggers when you leave.

Understanding tax in your new home

Before you leave, you should also obtain advice about when your new country will start seeing you as a tax resident and what your obligations might be.

South Africa has Double Taxation Agreements (DTAs) with a large number of countries that affect the taxing rights each country has over taxpayers. These agreements exist to ensure you're not unfairly taxed in both jurisdictions, but they can be confusing to navigate.

As you can see, planning ahead is crucial to avoid paying unnecessary tax. A cross-border tax accountant can advise you on when to leave, when to change your tax status, when another country might see you as tax resident and how to plan your move to suit your own personal circumstances.