IR35: Many contractors are still not prepared for the change

A 2019 survey conducted by YunoJuno, an online marketplace for freelancers, revealed that 67% of contractors were unaware of the upcoming changes to IR35. Over 26% said the changes would affect the contracts they accept after the legislation comes into effect.

IR35 in a nutshell

The legislation around IR35 is not new – it’s been in the pipeline since 2000. In 2017, an updated version of IR35 was introduced specifically to the public sector and from 6 April 2020 new legislation that extends IR35 will come into effect in the private sector.

IR35 generally applies to contractors who work through their own limited company but work effectively as employees. When caught inside IR35, it affects the way the amount of tax that must be paid.

The new rules, proposed for effect from April 2020, will force the “fee payer” in the supply chain in the private sector, to be responsible for deciding the employment status of the contractors or freelancers they use. Until the April 2020 rules come into effect contractors are responsible for assessing their own status. Should your contract and working practices cause you to fall inside IR35, you will be required to pay standard employee tax rates on all income into your limited company. These rates are significantly higher than the corporation tax rate and can reach up to 40%.

See also: IR35: Are you in or are you out?

Is there an alternative?

In the YunoJuno survey, 25% of contractors said they would reconsider working for a sole client to try avoid being caught out by the regulations, while 18% said they would raise their fees to counter the additional taxes.

There’s also the option of working through an umbrella company. While working through an umbrella company makes contracting much easier and simpler since you no longer need to worry about whether you’re IR35-compliant, you will still pay standard employee rates.

When to consider working through an umbrella company

Any contractor can use an umbrella company, and for some it may be more beneficial. You may want to consider an umbrella company if you’re:

- New to contracting and looking to get a feel for self-employment before starting your own limited company

- Unable to or do not want to be the director of a limited company

- Contracting for a short period of time

- Earning less than £15 per hour

- If your agency or end-client requires it

See also: Self-employment vs. contracting in the UK: What’s the difference?

How does an umbrella company work?

An umbrella company acts as your employer, which means you’ll pay standard employee income tax. Although your umbrella company is your employer, they are not responsible for getting you work or helping you earn a living in any way. You will still be responsible for securing your own contracts.

As an employee of an umbrella company you’ll be eligible for benefits typically not afforded to contractors and freelancers. This includes holiday pay, sick pay and statutory and maternity pay. The pay rate for these benefits is based on the amount you receive from the umbrella company, not the rate you charge clients. So, if you earn £200 a day through your umbrella company, that is the amount you’ll receive.

Your responsibilities

When you work through an umbrella company, you only need to ensure that you submit your timesheet and log all your expenses. Your umbrella company will take care of all your accounting and bookkeeping responsibilities and for this they charge a fee which is deducted from your income.

What happens after you’ve joined an umbrella company?

Contracts and invoices will be between the agency, client and your umbrella company. Together they will ensure that all agreements are binding and legitimate.

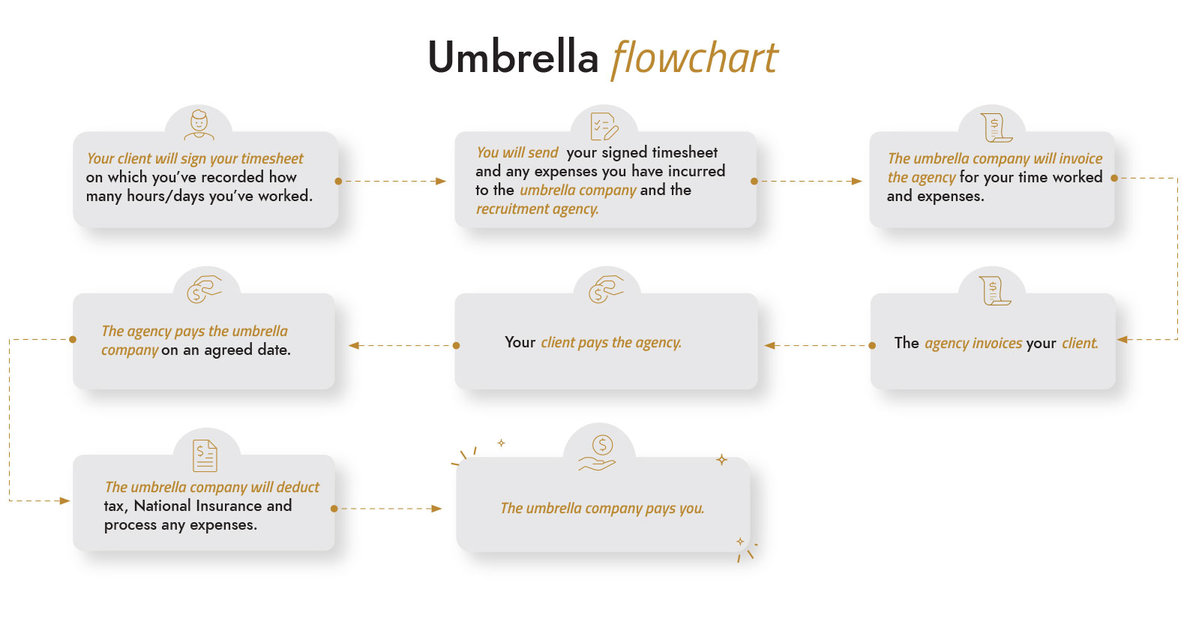

When you work through an umbrella company, you will usually follow the process in this flowchart:

Advantages of working through an umbrella company

All your finances are managed

Your umbrella company will ensure that your National Insurance and taxes have been deducted and are up to date. These will also be sent to HMRC for you.

Claim expenses back

You can claim back expenses for travel, tools and equipment. This will be managed by your umbrella company and all you need to do is ensure that you log your expenses.

Be your own boss with employee benefits

Working through an umbrella company means that you’re effectively viewed as an employee. This means you’ll be eligible for sick pay, maternity/paternity leave and pay and holiday or redundancy pay. You’ll also be covered with workplace insurances.

Less admin, less to worry about

As opposed to running your own small limited company as a contractor, having all your admin and taxes taken care of gives you piece of mind and time to enjoy the flexibility your work offers or take on more contracts.

See also: Get the most out of being a contractor in the UK by following these simple steps

How to choose an umbrella company

There are some important things you must consider before signing up with an umbrella company.

Do a background check

Start by looking into how long the umbrella company has been operating. Speak to other contractors and find out about their experience with a company. Read reviews, ratings and visit contractor forums to find out whether a company has a good track record of supporting contractors. You should also do a credit rating check.

Be careful of companies offering to increase your take home pay and reduce your tax liability

This kind of arrangement puts you at risk of being part of a tax avoidance scheme. While your umbrella company is responsible for ensuring your tax gets deducted, you are ultimately responsible for your own tax affairs as far as HMRC is concerned. You will be liable to pay any additional tax, interest and even penalties should you partake in any tax avoidance scheme.

Understand the fee structure

Make sure to find out exactly how much you will be paying each week or month. Check if the fee is fully inclusive or if you have to pay extra to process expense and tax forms. If they offer a free service, find out how and why they are able to do this.

Get a full contract of employment

When you join an umbrella company, you become an employee of the umbrella company. This entitles you to all the statutory rights and benefits that UK employees receive. Check that a full contract of employment is offered.

What to do with your limited company if you switch to an umbrella company

Should you decide to work under an umbrella company, you’ll need to decide what to do with your limited company. You can either close your company or make it dormant.

Making your company dormant

A company is classified as dormant when it’s no longer trading or receiving any income. To make your company dormant, you must register your company as dormant with HMRC. If your company was previously active, HMRC will let you know if you need to complete a Corporation Tax return for that tax period.

Your company will still be registered with Companies House. Directors of limited companies must continue to file certain documents with Companies House, even if your company is dormant. These are your company’s:

- Annual accounts, which show that you have not been trading

- Annual confirmation statement, which details your company’s officers and physical address

If you register your company as dormant but continue to trade, your company will automatically lose its dormancy status. Dormant companies are only permitted to make the following types of transactions:

- Settle a civil penalty

- Pay the Registrar of Companies

- Payments for shares taken out by subscribers of the company’s memorandum of association

How long can your company remain dormant?

There is no time limit on how long you can keep your company dormant. If you’re certain that you won’t be trading through your limited company in future and want to avoid the hassle of submitting documents every year and the associated costs of keeping it dormant, then it may suit you to close it.

If you want to activate your dormant company again, you only need to inform HMRC within the first three months of trading.

How to close your limited company

There are two ways to close your company if it’s solvent (can pay its bills):

- Strike it off the Companies Register

- Member’s voluntary Liquidation (MVL)

Striking your limited company off the Companies Register

This is the process of removing your company from the register of the Companies House. You can only apply to strike off your company if in the last three months your company has not:

- Traded or sold off any stock

- Changed names

- Made any agreements with creditors

If your company has done any one of the above, then you will have to wait another three months before you’re able to remove it from the register.

Apply to strike off your company

You will need to complete a DS01 form which must be signed by the company’s directors. Once your form has been sent to Companies House, you’ll get a letter informing you that your form has been received and filled in correctly. Your request to have your company struck off will be published in your local gazette.

If there are no objections, your company will be struck off the register. Once the second notice is published in the gazette, your company will no longer exist.

Liquidate your company

If your company is solvent you can choose to liquidate your company via a Member’s voluntary Liquidation (MVL). You’ll need to write a statement saying that the directors have assessed the company and believe that it can pay its debts with interest at the official rate. Your statement must include:

- Your company’s name and address

- Names and addresses of the directors

- How long it will take your company to pay its bills (no longer than 12 months from when the company is liquidated)

Once the liquidation process has been completed, your company will be dissolved and cease to exist.

The closure options mentioned above are not the only ones but the most used. For other closure options, speak to an experienced contractor accountant.

Whether you decide to contract through a limited company or an umbrella company, it’s important that you fully understand your role and responsibilities for either option. If in doubt, get advice from an expert who specialises in contracting in the UK.