Whether you’re starting a new business or looking to expand a successful one, a big challenge for entrepreneurs is finding the funds.

Debt versus equity

Debt financing is a way to fund your business venture by borrowing money. The main appeal of using debt as a funding method is that you retain ownership of your company. The flipside is that you’re obliged to repay the lender and if you fail, the lender could force you to liquidate.

Using equity to fund your business means selling ownership in your company. You aren’t obliged to repay the investor but you must give them a portion of your business and potentially lose partial control over decision-making.

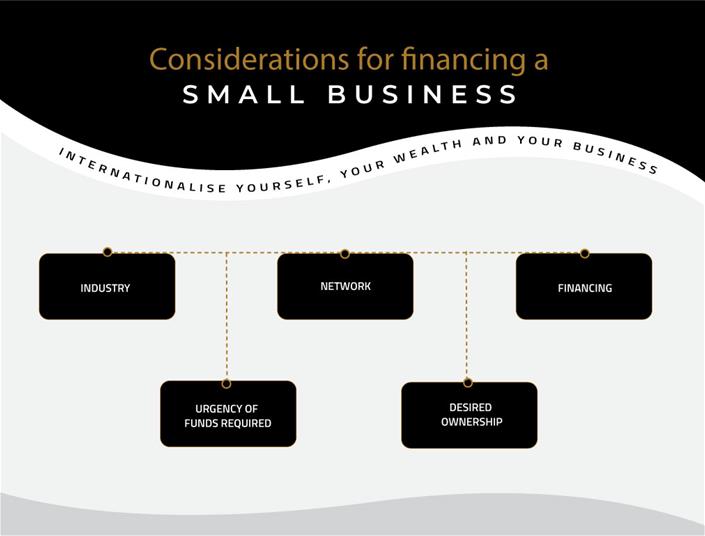

Choosing which type of small business funding you need

Here’s what to consider when you need external funding for your business:

Your industry

Technology companies, financial companies and healthcare companies promise good returns which makes equity financing a more attractive option for investors.

Your network

What social circles are you part of? The more people you know the better your chances of meeting “the right” people, or people of influence who can bring other investors into your business with them.

The amount you need

Equity financing is ideal for startups – they require large amounts of money to develop their office space, employees, development, etc. If you have an established business and you’re looking for a bit of extra capital, then debt financing is a better option.

How quickly you need funding

If you need your funding fast, online debt financing is your best bet. Traditional bank loans are sometimes a slow process, but alternative lenders can provide you with the funds sometimes within a day or two.

How much ownership you want to keep

Selling ownership in your business is possibly the biggest factor to consider. As part-owners, investors can have some control over the day-to-day decisions and this could limit your ability and vision for the business.

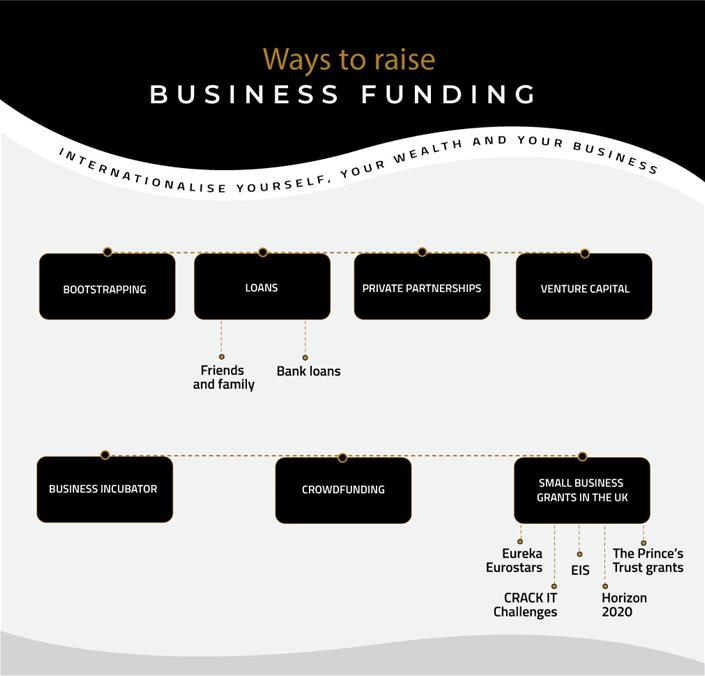

How to raise business funding

Here are a few different ways to secure funding for your business that vary between equity and debt funding. If you have any questions or are seeking advice, take a look at our small business accounting services.

1. Bootstrapping

Plenty of successful businesses have been built without any external funding. When it’s still early days and you’re in the experimental phase of your brainchild, start scraping together any and all personal funds you can spare. Using the money you’ve accumulated over the years is better than borrowing money from friends and family right away.

Slow and steady wins the race, but if you want to scale your business quickly, bootstrapping might not be enough. It could be more beneficial for you to bring in an external source of funds.

See also: Mini Budget Statement 2022: What you need to know

2. Loans

Friends and family

If you don’t have your own savings or your growing business needs additional funding, consider inviting friends and family to invest in your business. They can provide either equity or debt funding but make sure you and your investors know all the risks. Businesses fail and can go through hard times which can lead to hurt feelings and strained relationships. Whether it’s a loan, a gift or investment you’re asking for, make sure they’re aware that their money may not be returned.

Bank loans

Certain banks have allocated additional funds for small business lending. Banks’ lending standards have become more stringent and will likely require you to provide collateral in the form of assets to secure your loan. This source of funding is best for established business owners who have a strong credit score. If your business is doing well and you need the loan to help you expand even more, a bank loan might be a good option.

Have a question about business loan applications?

Contact usThere are numerous funding options available in the UK. A simple Google search will yield a list of the many different small business loan providers in the UK.

3. Private partnerships

A strategic partnership could give your business access to new products and markets, help you overtake a competitor and increase loyalty. The goal is to find your customers pain points and a partner that can resolve them and benefit both parties equally.

Your business purpose will ultimately determine who you partner with, so before a partnership is formed consider the following:

- Do the brands share the same values?

- Do the brands product offerings complement one another?

- How will both partners benefit from the relationship?

- Do the businesses have the same or similar customer profiles?

4. Venture capital

If you are either in the early stages or want to grow your business significantly, you should lean towards venture capital. Venture capitalists (VCs) invest in a few different companies for their clients and hope to make money off one or all of them to pay back their client’s investments. VCs meet with a variety of businesses, so you need to stand out to get selected.

If you don’t have much of a network built up, then try looking at VC websites and pitch your business to investors online.

See also: What the UK dividend tax rate increase means for your small business

5. Business incubator

Incubators can also be referred to as accelerators. They are aimed at speeding up the growth and success of a startup by offering support in the form of education, mentorship and financing. Incubators are essentially a ready-to-go space and support infrastructure for your startup business. They can operate in a physical space used to foster networking between entrepreneurs or on a virtual basis.

Carefully evaluate your decision to get capital through an incubator. It’s also a business venture itself, often sponsored by private companies or municipal entities who will want to see a return on their investment.

Starting a business? Our UK business services can help.

Contact us6. Crowdfunding

Crowdfunding is typically a web-based project and can be a fun way to raise money for your business. This is not a means for long-term funding but rather to facilitate support for your initial idea and to help with expansion. It’s best used by business to consumer (B2C) startups.

Crowdfunding involves asking individual people to invest in your creative idea. There are a number of different platforms that are available so make sure you have done some research to find the one that is right for you and your business.

7. Small business grants in the UK

Most small business grants are funded by national, local and European government and aim to empower small and medium businesses to grow the economy and create jobs. Grant funding can reach up to £500,000 and the criteria differs for each grant scheme.

These are a few of the national government and business grants that could be right for your business:

The Prince’s Trust grants

The Prince’s Trust grants offer financial assistance to young entrepreneurs to help them start their own business. To be eligible you must be 18 to 30 years old. Fill out an online application to receive support or funding.

CRACK IT Challenges

These are challenge-led competitions that fund collaborations between industry, academics and SMEs to solve business and scientific challenges. Depending on the challenge, contracts of up to £1 million for up to three years are available. Find out more on the official website.

EUREKA Eurostars

Eurostars supports international innovative projects lead by research and development performing SMEs. To be eligible for a Eurostars grant, you must be an SME in the UK, be working in the tech industry and have the intention of collaborating with other European companies.

Horizon 2020

This is a large EU finance grant designed to support SMEs across Europe. You can access funding and expertise through UK government agencies and organisations. Horizon bids range from £100,000 to over £10 million. Get more information on the gov.uk website.

Enterprise Investment Scheme (EIS)

The EIS is focused on supporting companies in the middle or later stages of development. If your business is approved for the EIS you could get your investors up to 30% tax relief on investments.

Financing your business is an ongoing process, not a singular task.

With a well-thought-out business plan that effectively demonstrates the value of your company to your investors, you will be able to secure the funds necessary to move forward.