As a South African expat, It is essential to know your South African tax residency status because it is possible to leave South Africa and still owe tax in the country.

Firstly, when you leave the South African tax net, by undergoing tax emigration and changing your tax residency status, you will trigger a Capital Gains Tax (CGT) event, sometimes called “exit tax”.

Secondly, South African tax residents are taxed on their worldwide income – both their South African earnings and foreign income.

Finally, if you receive income from a South African trust, who pays tax on this income will vary depending on your tax residency status.

Do you need to pay exit tax?

Exit tax is calculated as if you, a South African resident, sold all your assets (excluding immovable property in South Africa and your RA) to a non-resident at market value on the day before the change of status, creating a capital gain that may be taxed. This CGT amount is then immediately payable.

Exit tax in South Africa is taxed at a lower rate than regular income because only a portion is added to taxable income.

The assets you had when you left are broken down into two categories.

| Untaxable assets | Taxable assets |

|---|---|

| Cannot trigger CGT | Can trigger CGT |

| Individuals are not expected to give the market value of these assets, but recommended if they have the values. | Individuals are expected to find the market value of these assets at the time they left. |

| - | Options for you to avoid admin penalties for non-disclosure of the tax events (voluntary disclosure programme) |

If you left South Africa with no assets, sorting your tax emigration out sooner rather than later means that you can get away without paying exit tax. The situation you want to avoid is SARS looking at your current, overseas, asset base for tax.

If SARS picks up that you should have paid tax when left and you didn't tell them, depending on your case, there could be up to 200% penalty tax. SARS is becoming more efficient at catching defaulters as it expands its automatic exchange of information with more countries.

The other potential risk is that if SARS approaches your current tax authority stating that tax is due then you will probably have both tax offices digging through your tax affairs since you moved, which no one wants.

Read more: SARS warns expat tax avoiders: We’re coming for you

Are you receiving funds from a trust?

Receiving funds from a South African trust is something that is often overlooked and can become risky for taxpayers. If a trust distributes income to a beneficiary, the type of beneficiary will determine how it will be taxed.

1. South African tax resident

For any assets or capital gains distributed from a trust to a South African tax beneficiary, the tax will be paid in the South African tax beneficiary's personal capacity in accordance with the tax laws.

2. South African non-tax resident

When a non-tax resident receives a capital distribution, the trust pays the tax on the taxpayer's behalf and distributes the proceeds to the beneficiary. The difficulty here is that many trusts have previously been distributed to non-residents, allowing these individuals to pay the tax in their personal capacity.

The issue is that once you've tax emigrated, SARS will claim that you should not have been taxed as an individual and should have been taxed in the trust, so the trust will have to pay the tax. However, you may not be able to claim your tax back in your personal capacity.

If you are a beneficiary of a trust and you have left South Africa, you should consider getting advice tailored to your circumstances around the treatment of any historic and future distributions.

Should you keep your tax number active?

An active tax number is a tax number in South Africa which you have not asked SARS to deactivate and/or where SARS has not deactivated it due to non-use (usually 15 years plus).

To determine whether or not your tax number is active, you will need to access your eFiling. If you no longer have access to eFiling, a tax practitioner can conduct an overall status check on your tax position on your behalf. SARS is however starting to make this more difficult to do.

If you have an active tax number, check what tax returns are required because these must be submitted after which you can then change your tax status and should you wish, deactivate your tax number. SARS is currently raising penalties on returns not lodged for active tax numbers – irrespective if they would cause a tax liability. In the past SARS allowed taxpayers not to lodge a return where they met certain criteria – SARS is renegading on this now and demanding some of these tax returns and penalizing taxpayers for late lodgment. For this reason, we recommend that while your tax number is active that you do your SA tax return.

If you have an inactive tax number, you do not need to reactivate your tax number to change your tax status only to deactivate your tax number again. If you have an inactive tax number and don't need it activated right now, wait until you do need one before changing your tax status.

You can safeguard yourself by gathering all of the documents you might need ahead of time. Copies of your South African passport, flight tickets and your memory of what you did in what month, for example, become more difficult to prove (or remember) later, if no record is kept.

Our South African Tax team can help you determine your tax status.

Get in touchWhen is the best time to get in touch with a tax practitioner?

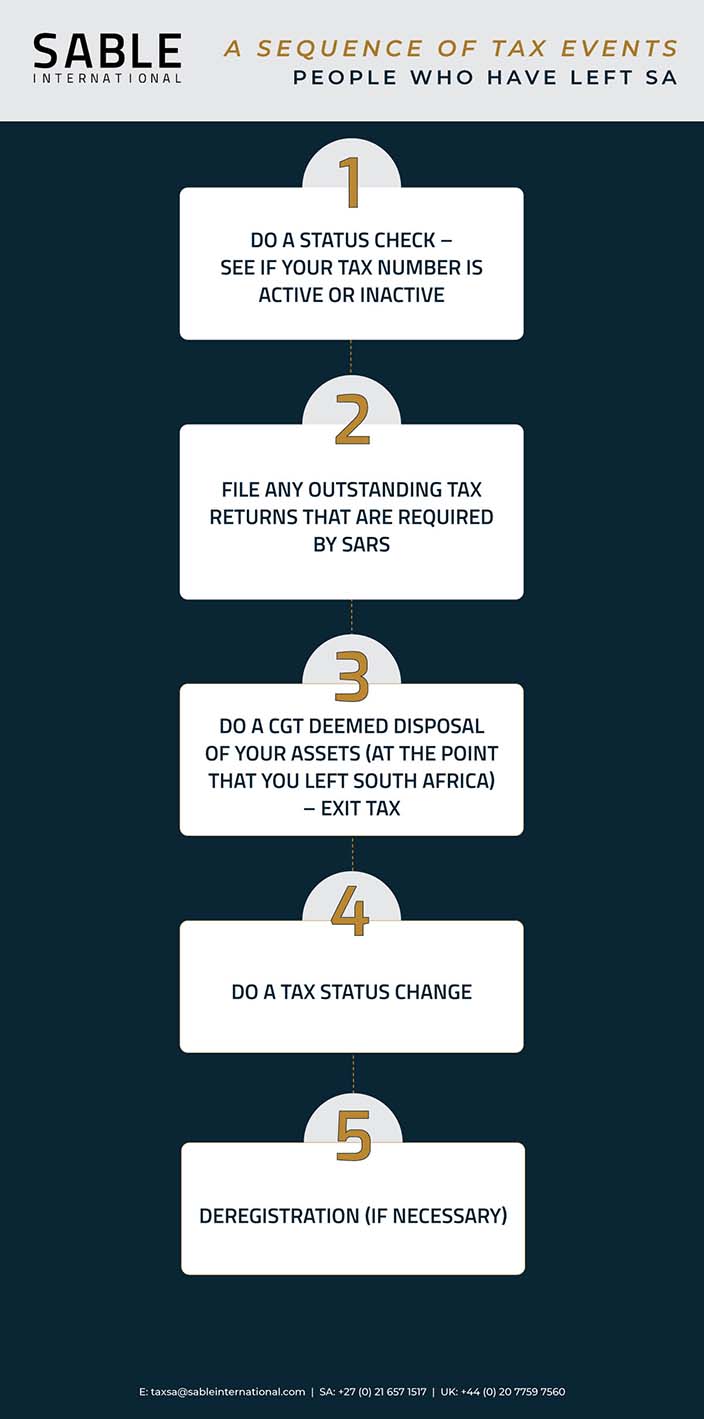

As someone who has already left South Africa, there can be no tax planning for your exit strategy, which means that your tax practitioner will assess your current situation and act accordingly. We recommend you follow this sequence of events if you left South Africa a while ago.

We recommend seeking professional advice before attempting to alter your tax status. Even if you are no longer a tax resident, you may still have reporting obligations to SARS.