How does the two-pot retirement system work?

The two-pot system will affect current and future retirement fund members in the private and public sectors, so it is important to understand how it will impact you.

The new system aims to address two primary concerns – the limited access to retirement savings in times of financial distress and the lack of preservation of retirement funds when members withdraw from their pension or provident funds when they leave their jobs.

Currently, pension and provident fund members can only access their retirement savings when they retire or withdraw from their pensions.

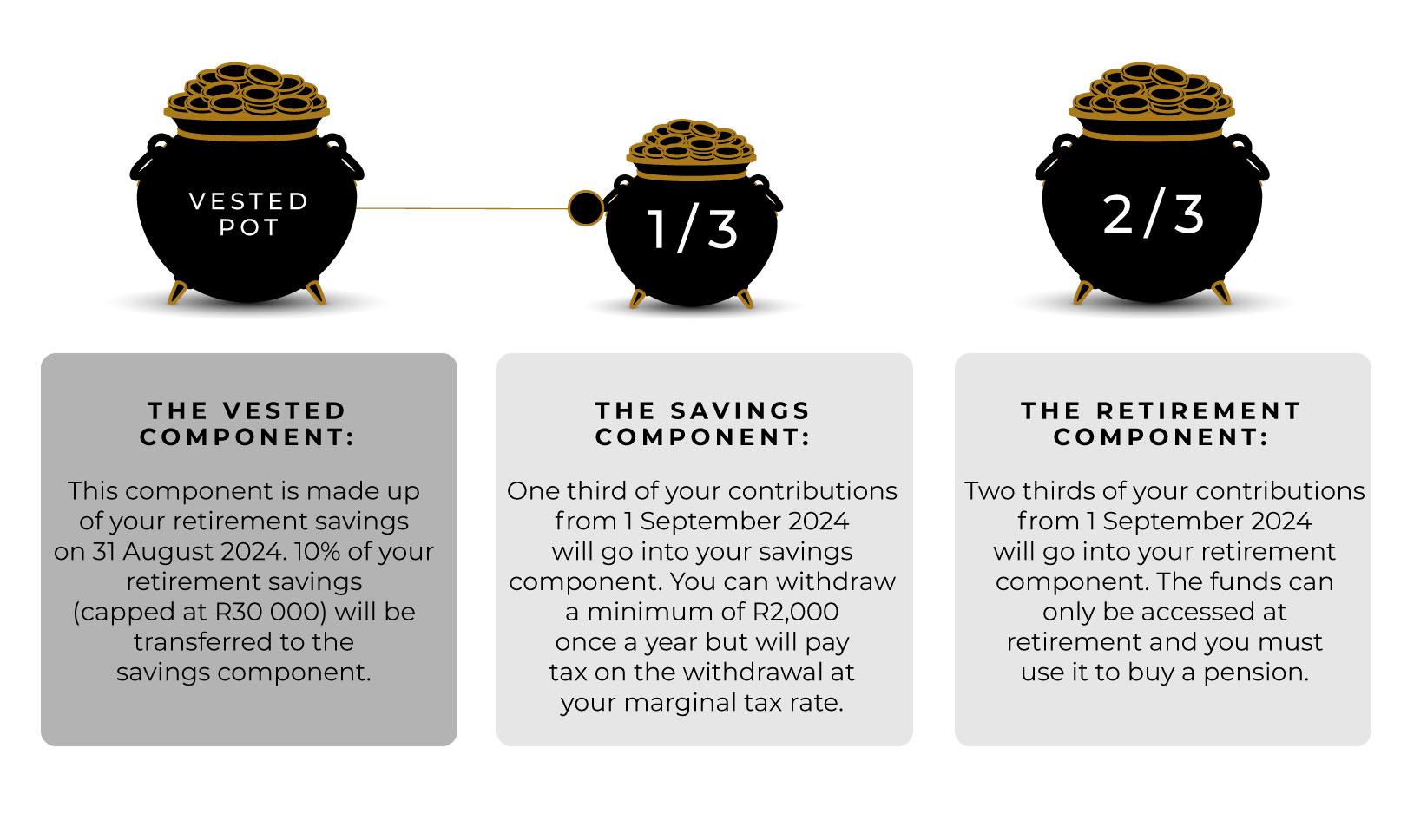

The new system introduces two distinct pots, now referred to as components – the retirement component and the savings component. Contributions made after 1 September will be allocated to these two components, while the existing accumulated retirement savings will be safeguarded in a third pot called the vested component.

From 1 September, a third of the contributions paid to a retirement fund will be allocated to the savings pot, while two thirds will be allocated to the retirement pot. Contributions exceeding the current caps for tax deductions will be allocated to the retirement pot.

There will be a once off allocation of 10% of your existing retirement savings (capped at R30 000) to the savings component to “kick-start” the allocation.

If you were over 55 on 1 March 2021, you will be excluded from the two-pot system, unless you opt in.

Accessing the savings component

Members will be able to withdraw funds from the savings pot once a year, subject to normal tax rates. The minimum withdrawal amount is set at R2,000, with no maximum amount, and members are not required to provide any reasons for their withdrawal.

The retirement component

The retirement component is designed to be preserved until you reach retirement age. Once you retire, the total value in the retirement component must be paid in the form of a monthly pension or, if the value is below a certain threshold, as a cash withdrawal.

The vested component

The vested component holds the existing accumulated retirement savings as of 31 August 2024 with no further contributions being made. The vested component retains its previous access rule which means that if you resign, are retrenched or change jobs you can still access it, but it will be subject to tax.

Benefits and considerations

Flexibility and access to funds

The two-pot retirement system introduces flexibility by allowing limited access to retirement funds. Members can withdraw from the savings component once a year, providing some relief during emergencies. However, it is crucial to consider the long-term impact of these withdrawals on retirement savings.

Preservation of retirement savings

By separating contributions into two distinct pots, the system encourages the preservation of retirement funds. You can only access this component at retirement, and you must use it to buy a pension. This is to ensure a stable income during your retirement years.

Tax implications

Withdrawals from the savings component will be included in the member's normal taxable income and subject to normal tax rates. This differs from lump-sum withdrawals upon termination of employment, which are subject to the Withdrawal Tax Table. The tax treatment aims to incentivise saving for retirement while discouraging frequent withdrawals.

Resignation, retrenchment and emigration

Currently, when you resign or are retrenched, you can access the full amount of your pension or provident fund as a cash lump sum, subject to retirement withdrawal tax. From 1 September 2024, you will still be able to withdraw capital held in your vested component.

Going forward, you will be unable to access the funds held in the retirement component upon resignation or retrenchment. The funds will only be available once you reach retirement age, and you will need to buy a pension.

If you emigrate, the amount held in your vested and retirement components will need to be held for a period of three years post-emigration before you can withdraw it. This is similar to the current situation with retirement annuities, but you will now be able to withdraw funds from your savings component once a year. However, it’s important to be aware of the tax implications of doing so.

So, if you are considering emigration and think of your retirement fund as a source of capital, you will need to understand the impact of the two-pot retirement system on your emigration plans.