We do not invest client money on the basis of any prognostications or forecast of global economic conditions or bets on one asset class over another. Our investment process rests on a thorough understanding of the historic performance of asset classes and their risk and return characteristics.

That said, an understanding of current economic conditions and the opportunities and challenges those conditions present, helps us form expectations around forward-looking returns over long time horizons. Furthermore, an understanding of the current trends helps outline structural changes to the global economy that unfold over decades rather than years or months. Therefore, as an investment committee, we keep ourselves abreast of both historic return analysis and forward-looking research. The observation of long-term trends informs and provides context to our portfolio decisions and the assumptions we use in our client modelling.

Macro-economic context

The global economy is entering a difficult period that has been forecast for a number of years by many commentators in the investment arena. To quote Jim Reid at Deutsche Bank1:

“2022 has been one of the toughest years for financial markets in decades. Bonds and equities are declining in unison, and we are now in the first global bear market for government bonds in 70 years. This means that split bond/equity portfolios are seeing big losses in 2022 after decades of exceptional returns.”

The genesis of 2022’s troubles lies in the QE policy response to the 2008/09 financial crisis which (necessarily) created elevated global asset prices coupled with large (and growing) government and corporate debt levels. This ‘twin peaks’ environment creates an ever more fragile economic system, as both asset prices and debt yields are sensitive to interest rate movements. Rising rates, therefore, puts downward pressure on equity while raising the cost of debt financing which, if both are elevated, can create simultaneous liquidity and solvency crises across public and private sector finances.

Since the 1980s, developed markets around the world have held interest rates below the natural level, resulting in strong incentives for investors to bid up the price of risk assets and for corporates to buy back shares and issue debt. Governments were equally incentivised to run large fiscal deficits in the period after the financial crisis to address tepid aggregate demand. This period of low interest rates and expanding money supply has been a good period for the classic 60/40 portfolio, with both the equity and debt portion of the portfolio experiencing tailwinds. While few would have predicted the Covid lockdowns or the Ukraine War that followed it, the fact remains that the global financial system entered these two crises in quick succession with the global economy in a fragile state. This fragility poses a risk of higher volatility and lower returns for portfolios.

As I write, the UK faces a unique set of challenges marked by the confluence of trade and labour constraints post-Brexit and the reliance on foreign gas supplies. The UK is therefore experiencing a severe spike in inflation which is creating a stagflationary recession. This current recession is likely to last into 2024. The EU has been hardest hit by the gas supply issues related to Russia’s war in Ukraine and the impact on inflation (and GDP) in the EU is likely to be severe this winter and through 2023.

Global inflation likely to peak soon but feed into broader prices looks set

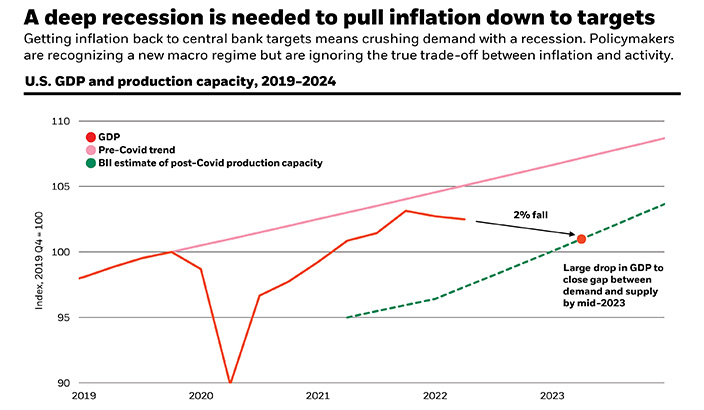

Through 2022 there has been considerable debate on the issue of ‘transitory inflation’. While we don’t expect inflation will remain at current peak levels, the feed-in effect to core inflation is now evident and the wage-price spiral effect will increase chances of a global stagflationary recession. The policy response in the US, UK, and Europe is perfectly understandable with inflation at current levels. It’s possible a global recession is required to normalise prices2:

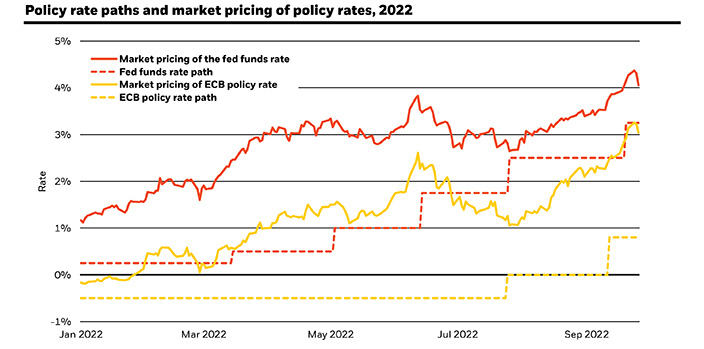

The understandable response from central banks has been to raise interest rates even as the outlook for a recession became more evident3:

See also: Should we be worried about inflation when investing?

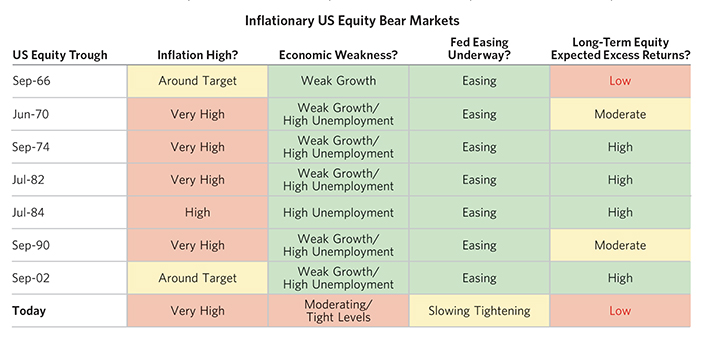

Policy errors likely as the current situation has no historic precedent

Inflationary episodes feature prominently in economic history textbooks but none have the distinguishing features of the current crisis. It’s important to remember that where central banks have an explicit target, inflation is most likely to move toward that target as tightening monetary policy zero or negative rates will sharply reduce aggregate demand. The table set out below from Bridgewater Associates4 indicates how some of the key features of our current situation in the US are unique by historical standards.

The unique challenges of the macroeconomic environment co-exist with a changing political structure. The decline of American leadership is noticeable as the west faces its most direct threat in the form of Russian aggression in Ukraine. These geopolitical challenges co-exist with higher levels of internal disorder in G7 countries. Much of the rising internal disorder is a function of an acute cost of living crisis amidst deteriorating wealth and income inequality within wealthy countries. All of these aspects increase the likelihood of a higher level of political volatility going forward and therefore the possibility of policy errors on economic management.

Lower growth and higher volatility

While stock and debt market valuations have improved from the Jan 2022 peak, we have high equity valuations (in relative historic terms) and higher debt volumes. Higher equity valuations reduce forward-looking expected returns and rising interest rates increase the cost of capital, while the existing stock of debt needs to be serviced and refinanced. These factors, along with ageing populations, when rolled together, act like a handbrake on growth momentum. Therefore, while our expected returns on both equity and bond portfolios have improved from January 2022, expected returns are still lower than historic returns when measured for the period 1980 to present.

Portfolio impact of macro-economic picture

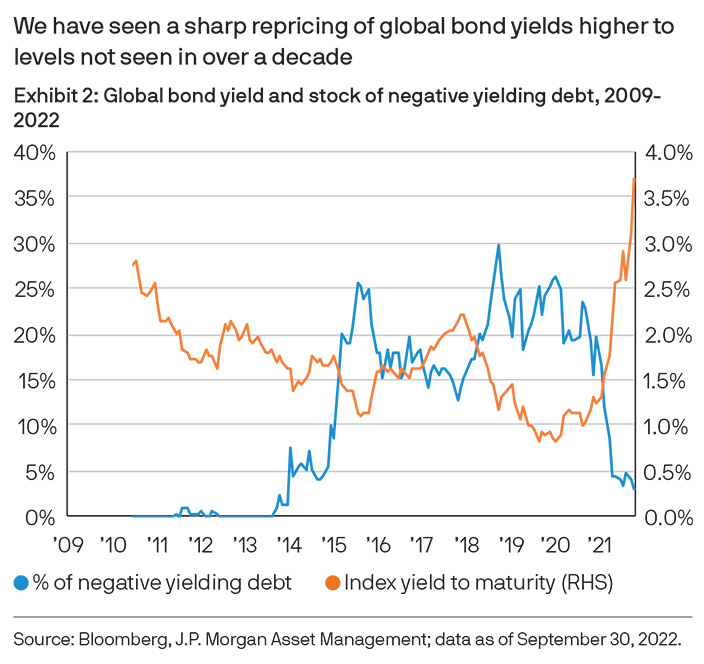

2022 saw drawdowns in most asset classes but the most severe was in global bonds, which had their worst year in history5. A 30-year regime of low and falling interest rates with low inflation suddenly reversed to normalise the capital conditions in a very short space of time. The following charts indicate the dramatic decline in bond prices this year:

In the chart below you can see the dramatic reversal in bond yields in 2022 along with the sharp fall on the stock of negative yielding bonds globally6.

Importantly, on a forward-looking basis, yields in bond markets are now at more attractive levels than at the start of the year.

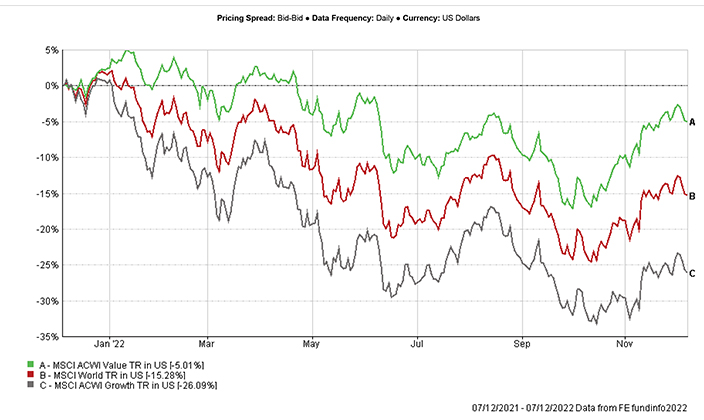

In the stock market we’ve seen falls in a number of equity indices around the world. The MSCI world index is down 10.73% this year but the graph below indicates the reversal of fortune between two sides of the markets, that is value and growth.

This relative outperformance of value stocks relative to growth stocks is to be expected when the cost of capital rises quickly as we’ve seen this year. JP Morgan called their Long Term Asset Class Return forecast report “Back to Basics’ for this very reason. As the cost of capital has risen, so companies that are heavy users of cash are traded down in favour of companies that generate cash. This has reversed a trend of growth outperforming value for the period 2014 through to the post-Covid recovery. The extent to which the value outperformance trend continues will depend on the cost of capital in the years ahead and that, in turn, will hinge on inflation and interest rates.

See also: Investing for the long game: the value of value stocks

The downward pressure on the overall stock market may not be at its end, but each step down improves the expected future return on the overall market for equity holders.

The expanding role of sustainability and ESG in portfolio construction and asset pricing

Largely driven by the EU, we are witnessing an acceleration of renewable energy infrastructure incentives, funding and regulation that relates to sustainability in the investment arena. The global finance ecosystem is gearing itself to become accountable to clients and regulators on the impact of investments on global sustainability initiatives. This trend has been underway for a number of years but is now accelerating in a manner that is and will continue to affect asset pricing and investor choice. The filtering of investment portfolios by ESG and/or sustainable criteria affects all aspects of investment outcomes in ways that are not yet clear and will only be clear in hindsight.

For example, strict ESG filtered portfolios will have underperformed conventional portfolios significantly in 2022 due to overweight positions in the EU and in tech stocks, and underweight positions in fossil fuel resources.

See also: ESG: The sustainable investment opportunity

Conclusions

The current stagflationary context yields forth a difficult winter for the Northern Hemisphere but, beyond that, the price adjustments in debt and equity markets have considerably improved forward-looking expected returns. Aggressive action by central banks seems likely to bring inflation back to manageable levels and a retreating Dollar will ease the pressure on emerging markets. Therefore, our view would be if you look past the frosty winter ahead there is much to celebrate for the longer term investors out there.

In these unprecedented times, it’s more important than ever to carefully consider your investment strategy and the risks. Speak to us about financial planning to see how we can create the right solution for your needs. Email wealth@sableinternational.com or give us a call on +27 (0) 21 657 1540 (SA) or +44 (0) 20 7759 7519 (UK).

References

1 Deutsche Bank: Long-Term Asset Return Study 2022: How we got here and where we're going…

2 BlackRock Investment Institute: Global macro outlook

3 BlackRock Investment Institute: Global macro outlook

4Bridgewater Associates: How conditions today compare to past equity market bottoms

5 Reuters: Bond bear market: Worst year in history for asset as inflation bites

6 JP Morgan: 2023 Long-Term Capital Market Assumptions

Sable Private Wealth Management Limited is authorised and regulated by the FCA (no. 222501). Sable Private Wealth (Pty) Ltd is authorised by the FSCA (no. 48122).