US equity outperformance

Global equity markets continued to show persistent strength as many global indices soared to new heights. However, thestrength has been concentrated in Big Technology (Alphabet, Meta, Amazon, and Microsoft) and Semiconductors (Nvidia, Broadcom, Micron) leaving the NASDAQ and S&P 500 up 17.5% and 15.3% respectively at the 2024 halfway mark. Nvidia remained the biggest driver of gains in the tech sector given the extremely strong demand for chips used in the further development of artificial intelligence. As a result, we further emphasise the importance of diversification in our investment philosophy as we move through 2024 and believe that the portfolio tilts in place will be a key role player in delivering strong long-term returns as dynamics change.

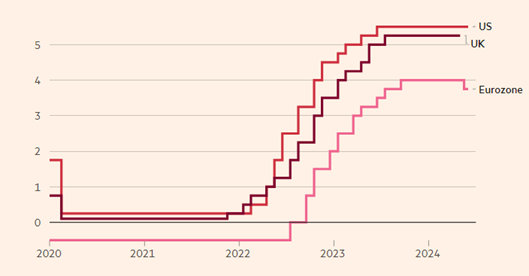

Global central bank stances

Central bank policy rates

(Source: Financial Times, National statistics offices via LSEG)

On 6 June 2024, the European Central Bank cut interest rates for the first time in almost five years to 3.75% which has not yet been replicated by US and UK central banks. The potential implications of diverging monetary policies will be closely watched by investors worldwide. The ECB rate cut was a strong first step that is starting to introduce the stimulus the European economy needs. European equity markets (represented by the MSCI Europe Ex-UK) returned 8.72% in the first half of the year. While the FTSE 100 delivered 7.88%, the UK equity market still fell short of both the US and EU equity markets.

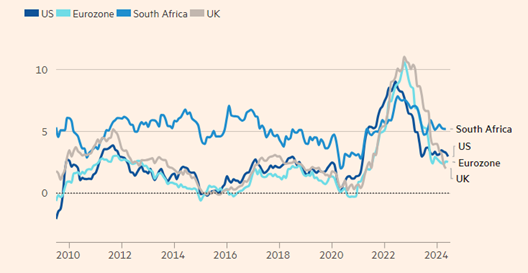

Global CPI movements

(Source: Financial Times, National statistics offices via LSEG)

Across major economies, disinflation appears to have taken a breather after a relatively rapid descent from 2022-23 highs. UK inflation has been slower to fall, but there has been resilience in the strength of the UK consumer to CPI movements. There are several factors that will result in upward pressure on inflation in years to come such as deglobalisation, energy transfer and regulation. While there are still many unanswered questions, it is highly encouraging that the global economy has successfully adapted to higher-for-longer (than expected) interest rates. Inflation remains the key risk to retired investors and investment strategies play an even more important role in catering for the erosion of the purchasing power of accumulated wealth.

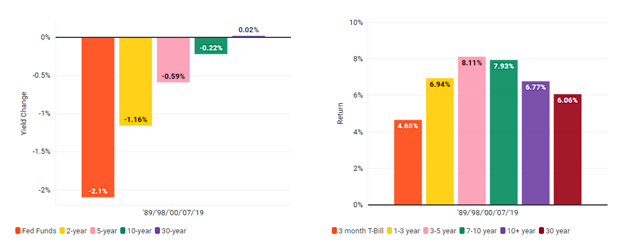

Fixed income opportunities and strategic considerations

The upward trend in 10Y treasury yields since 2020 has persisted and has seen yields remain higher than they have been for most of the past decade reaching 4.39% midyear. As a result, yields remain attractive in the bond space, particularly at the front end of the yield curve, but rate cuts are likely to have an impact on this in the next large cyclical move. If rates decline, high quality fixed income has the potential to generate attractive total returns and the negative correlation of US government bonds has and continues to be a strong risk buffer in volatile equity environments and has been a consistently strong performer during rate cutting cycles.

Bond market returns following policy normalization when yield curves are inverted

Average 12-month yield change (left) and average 12-month return (right) following curve normalisation

(Source: BlackRock, with data from Bloomberg as of 2/29/2024. Periods represent occurrences of an inverted yield curve since 1989, represented by a negative spread between the 2-year and 10-year US Treasury yields. Yield change and return calculations begin the month in which the yield curve normalized and did not reinvert before a rate cut by the Federal Reserve. Yields are represented by generic US Treasuries. Returns are represented by the respective ICE BofA US Treasury indices for each maturity bucket.)

During Fed normalisation, the yield curve tends to steepen as shorter maturity rates closely follow policy rates and longer dated rates tend to lag. Taking into account the combination of both yield change and duration, the highest returns have, historically, been found in the three-to-five-year part of the curve. This is a crucial part of asset allocation decisions and may play an even more important role in portfolios going forward where this asset class has been able to achieve a positive real return for the first time in over a decade.

In conclusion, the first half of 2024 has been marked by geopolitical instability and numerous elections worldwide. Despite this, both economic growth expectations and inflation coming under control have generally exceeded expectations, demonstrating resilience in global markets. Equity markets have continued to show strength and major technology has been in the driver’s seat. In the bond market, yields continue to offer attractive opportunities, particularly for high-quality fixed income. As we navigate the remainder of the year, our portfolios are strategically positioned to capitalise on evolving long-term market conditions, emphasising the importance of diversification and quality investment allocation decisions.