(The below blog is an adapted piece taken from our Dec 2020 Investment Committee report.)

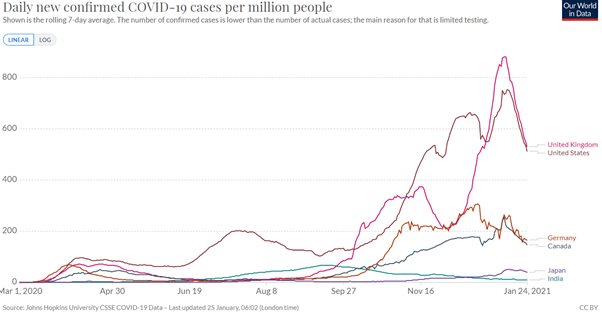

Early in March 2020 I correctly predicted a range of government responses to Covid (in the UK and elsewhere) that would in time seem farcical as we faced a foe too quick, too infectious and too small for us to manage. I was, however, wrong to suggest that the epidemic curve might be a 3 to 4 month one as we saw in China. Another timely reminder of the dangers of playing the prediction game with complex phenomena. Below is the latest daily case numbers data1:

The macroeconomic outlook

From a macroeconomic point of view, the pandemic has caused a sudden drop in global output and worsened an already problematic global level of debt. In the decade leading up to the pandemic we have a steady expansion of the total stock of global debt to historic levels. This is happening at the same time as asset prices reach historic levels. According to the World Bank, global output is expected to expand 4% in 2021 but remain 5% below pre-crisis levels. Global Growth is expected to moderate to 3.8% after 20222.

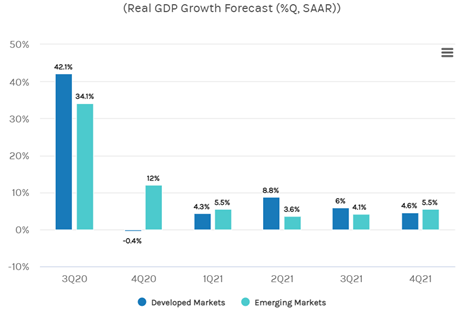

As we emerge from the pandemic, policymakers will need to redouble efforts at restructuring of debt arrangements for developing and poor countries worst affected by the pandemic, while wealthy countries address affected sectors to maintain global financial stability. The pandemic is also expected to steepen the expected slowdown in global growth, which is expected to remain below pre-crisis levels for an extended period beyond the crisis. An important objective for policymakers around the world will be a coordinated response to prevent a debt crisis starting in the emerging and developing countries. Such a crisis could have contagion effects that would be difficult to manage when fiscal conditions are strained in public sectors across the globe. With vaccines in roll-out, thoughts naturally turn to the nature, speed and composition of the recovery. The consensus view is a faster recovery in developed markets compared to emerging and developing markets. Morgan Stanley's forecast of recovery rates are as follows3:

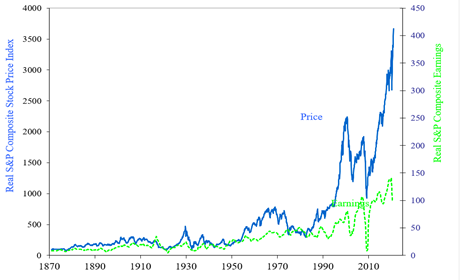

Asset price levels and CAPE

High asset prices and ultra-low interest rates post the Covid crisis exacerbate an already challenging investment landscape for pension funds, endowment funds and private investors alike. The further above earnings the starting price is, the lower the expected long-term return. Low debt yields that fall into negative territory create losses for investors and the likelihood of higher correlation between equities and bonds increases. Today's investors pay four times the price for the same earnings in the equities market compared to those investing in the 1990's. This is illustrated graphically below by Prof Robert Shiller's Cyclically Adjusted Price Earnings data4:

At the same time, on the bond side of the portfolio, today's investors earn a tenth of the yield for fixed income investments compared to the late '70s and early '80s as shown by the historic US treasury yield curve5:

These are significant challenges for portfolio managers and highlight the need for a sober conversation between clients and advisers about the realities of the savings landscape and the outlook for future returns.

Biden's Green New Deal

In the context of these challenges some significant opportunities are presenting themselves. Biden's New Deal could result in a $2 trillion fiscal stimulus package that involves the 're-tooling' of the US economy from petro-fuels to renewable fuels. The private sector crowding in opportunities involved in this will be some of the most significant investment opportunities in a century. With no shortage of capital in the system, we should expect price volatility in this area and a phase of sorting out the ideas that will stay from those that will fail. Tesla is a precursor to this 're-tooling' process and we are likely to see this effect in other areas. We advise our clients to tread carefully and walk this path eyes wide open with your investment advisers. We are constantly watching this area as it affects our investment models.

Inflation expectations for investors

As I mentioned in the previous investment committee report, this crisis has seen monetary policy stimulus at historic record levels of volume (currently estimated at $12 trillion in total6). This has given rise to two divergent views on the path for inflation and interest rates post the pandemic. Much of the thinking around higher inflation can be traced back to the highly influential teachings of Milton Friedman:

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.7

This idea is still taught in economics classrooms today. It essentially explains inflation outcomes as the simple relationship between money supply and economic output. However, this argument has a pre-condition for a stable velocity of money. We have seen the velocity of money in the financial system fall since the 2008/09 crisis and fall again further during the pandemic. Proponents of this argument assume a resurgent velocity of money post the pandemic. We're not convinced that's a guaranteed outcome.

On the other side of the argument are those who argue for a future of 'lower rates for longer'. Here, the argument is that demand has fallen during the crisis and may not fully recover for some years as the higher unemployment and economic scarring from the crisis take years to recover. Demand patterns will have shifted too as people take time to return to travel and employment prospects change consumption patterns. Adding to this argument is the historical perspective that periods of hyperinflation usually involve some kind of supply shock influencing supply/demand dynamics in the economy8.

Again, we are dealing here with a highly complex, emerging phenomenon. Olivier Blanchard, Professor Emeritus at MIT and Jean Pisany-Fery (European University Institute) make the point in their blog on the subject that Central Banks have not discarded their price stability mandate9. They argue that despite the sheer volume of assets now sitting on Central Bank balance sheets and the fact that in some jurisdictions these asset purchases have amounted to direct monetisation of the deficit; inferring a simple and clear path to inflation from here is too simplistic. That argument ignores both the existing Central Bank mandate along with the many powerful mechanisms at the disposal of central banks to implement that price stability mandate.

Furthermore, if there was a consensus within financial markets of resurgent inflation, then we should be seeing this priced into the indexed linked yield curves as shown by the Bank of England. We see no such consensus in the pricing of indexed linked bonds10. Our view is that it is too early to say if either or any of these outcomes is likely, but we continue to watch the developments closely.

Investing during times of inflation

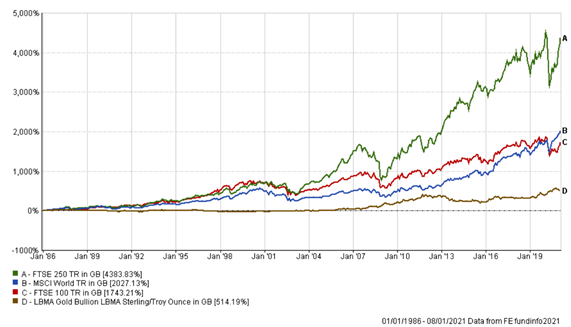

If the inflationary scenario did start to emerge, we thought it useful to explain how we might approach it. As a starter we should remind ourselves inflation is generally neutral or good for equities as input prices are matched with higher product/service prices. Therefore, equities provide the natural hedge against inflation. Furthermore, a globally diversified equity portfolio ensures that you are invested in areas with high and low inflation. Bonds do less well in inflationary periods as the inflation rate discounts the future cash flows. Therefore, it is possible one will see losses on long bonds when inflation rates rise. However, like the equities arguments, the world has many economic zones and its unlikely all will experience inflation at the same rate, at the same time, across all economies. The gold bulls became very active in investment media as the inflation narrative gained pace and we saw the gold price peak in summer 2020. Gold is often touted to be the fool-proof inflation hedge. We take the view that this relationship is murky at best. Evidence of Gold being a poor long-term investment is not that hard to find. See below for the long-term return for various equities indices vs Gold since 1986.

On an inflation-adjusted basis, Gold is not yet back to levels seen in April 1980. Equities have compounded many times since then. This what we would expect to see. Gold is a commodity with limited industrial uses that holds a fascination for some who have lost faith in the concept of 'fiat' currencies. Rather than offering a natural yield, it has a negative yield generated by its storage and insurance costs. In addition, gold now has a number of competitors in its role as a holder of value and alternative exchange currency – here I refer to the many versions of cryptocurrency. Gold's scarcity value is, in our view, illusory due to it not having any use apart from the buyer's desire to hold it and sell it on for a higher value (to a lesser informed buyer?). Thus, in our view, it continues to be a speculative vehicle and not an investment.

Financial Markets Sector dispersion (continued)

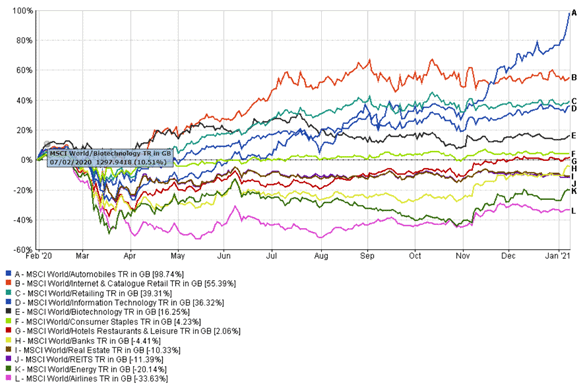

Previously I've explained how sector dispersion (i.e. the gap between winners and losers) across sectors had expanded to historic levels since the start of the crisis. That expansion and dispersion continues to be extreme. Noticeable changes are improvements from those worst affected. Airlines were down 50% as a sector in May 2020 when we wrote the first letter. Now the sector is only down 34%. The winner is Autos — up 98% since 1 Feb 2020, influenced significantly by the arrival of Tesla into the index.

Shifts within the index

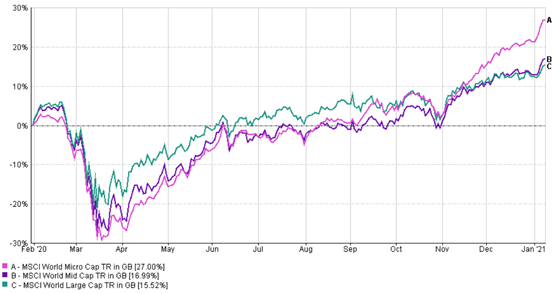

Value vs Growth: The crisis saw large US tech companies (sometimes referred to as the FAANGs) become the new defensive stocks and, given their sheer size, they caused the Growth index to pull further ahead of a lagging Value index. This has led to worryingly frothy PE ratios at the top end of the S&P 500 index. On news of the arrival of vaccines and now again on news of the possible Democrat Senate in the US, we've seen Value resurgent vs Growth. This is a good sign and an indicator of the market expecting a more broad and balanced recovery on the horizon. Within Small cap vs Large cap, we saw large caps hold up well through the crisis and recover quickly. More recently, small and micro-caps have begun to rally. The graph below shows the healthy rally for microcaps that suggests optimism of a post-Covid vaccinated partial return to normal.

Research themes – fixed income

Recently, we've been thinking hard about fixed income as we approach peak money supply and look for the Covid exit door. It has long been our view that fixed income investing is a key part of any diversified portfolio and should play a part in all but the most aggressive portfolios. That said, we find ourselves in a situation where a significant and growing portion of the short-term sovereign debt from advanced countries is zero or negative yielding. Therefore, we're focusing the fixed income side of our model portfolios on passively capturing the roll down return available in markets with positive sloping yield curves. A passive holding of debt instruments in a market with a positively sloping yield curve generates a natural (and passive) yield as the instrument is held over time. It is this natural yield we are trying to capture where it is available, and we are trying to do that without venturing into the guesswork around the future movement of interest rates, inflation or the next move by any central banks.

Final comments

Covid-19 remains the greatest challenge here today and now. However, the vaccine rollout has started and financial markets are looking to the post-Covid future. As long-term investors we should do the same. It's worth remembering the old Persian adage:

This too shall pass

1 See: Our World in Data Coronavirus Pandemic Statistics and Research

2 See: The World Bank Global Economic Prospects

3 See: Morgan Stanley Global Economic Outlook 2021

4 See: Online Data Robert Shiller

5 See: Macrotrends: 10 Year Treasury Rate - 54 Year Historical Chart

6 See: McKinsey & Company: Total stimulus for the COVID-19 crisis already triple that for the entire 2008–09 recession

7 See: The Counter-Revolution in Monetary Theory

8 See: The Economist: The Roots of hyperinflation

9 See: Monetisation: Do not panic

10 See: Bank of England: Yield curves