The major benefit of diversification is the reduction in portfolio risk by decreasing exposure to any single element. In addition to this, research1 published in recent years has shown that there are significant added benefits to international diversification.

Failure to diversify across international markets is often referred to as ‘home’ or ‘domestic’ bias. There are a number of reasons for this; ease of access to information regarding local firms, or inexperience as well as anxiety with regards to offshore investment and the potential tax or cost implications which may arise. Many of these biases and concerns may be unwarranted, but perhaps more importantly, investing solely within domestic equities presents a significant opportunity cost.

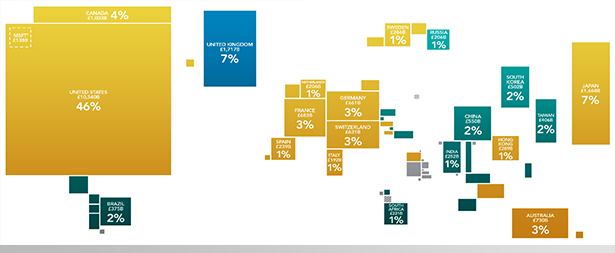

Global stock market sizes

The chart below depicts the world not according to land mass, but by the size of each country’s stock market relative to the world’s total market value. Whilst the US is by far the biggest market, it is interesting to note the wide dispersion following that. China, Japan, Germany, France and the UK – which make up the next five biggest economies (as measured by GDP and according to the World Bank) – make up a combined share of just 22%. The implications here are significant as the domestic investor in developed financial centres such as South Africa, or even Spain and India, are exposed to just a fraction of the global equity market, heightening local market risk, whilst limiting exposure to offshore gains.

Figure 1: World Market Capitalisation (£23.1tln as at 31 Dec 2012)

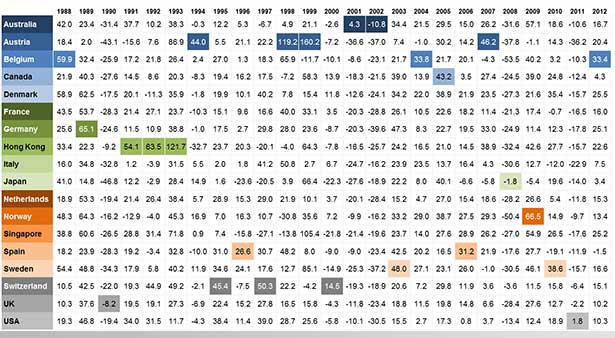

Annual equity returns of developed markets

With this knowledge at hand, the prudent investor may make an effort to diversify across international markets. However, the question remains as to where exactly they should place their money? The chart below shows annual equity returns of developed markets. Interestingly, the USA outperforms its peers on just one occasion, thus market size is perhaps not the best indicator of where to invest.

Figure 2: Equity Returns of Developed Markets (Ann Ret, GBP %)

The importance of portfolio diversity

It is clear then that there are significant benefits to invest outside of your domestic market, but as it is near impossible to determine which market will deliver optimal returns, it makes sense to diversify across as many countries as possible. This will expose your investment to the largest and most developed capital markets, whilst elevating your risk-adjusted return.

This is easier said than done, and opening up your portfolio to international markets may seem like a daunting prospect. However, this need not be the case. Sable investment portfolios are, by construction, heavily diversified across global financial markets. Furthermore, given the nature of the funds in which they have been invested, costs have been kept to a minimum. As a result, by moving your portfolio over to Sable, you will enjoy all the benefits of an internationally diversified portfolio at a cost likely to be lower than a domestically invested fund.

If you have any queries, or for further information regarding our fund offerings, please feel free to contact our wealth team on + 44 (0) 20 7759 7519.

1See:

French, Kenneth; Poterba, James (1991). "Investor Diversification and International Equity Markets." American Economic Review

Tesar, Linda; Werner, Ingrid (1995). "Home Bias and High Turnover." Journal of International Money and Finance

Coval, J. D.; Moskowitz, T. J. (1999). "Home Bias at Home: Local Equity Preference in Domestic Portfolios." Journal of Finance