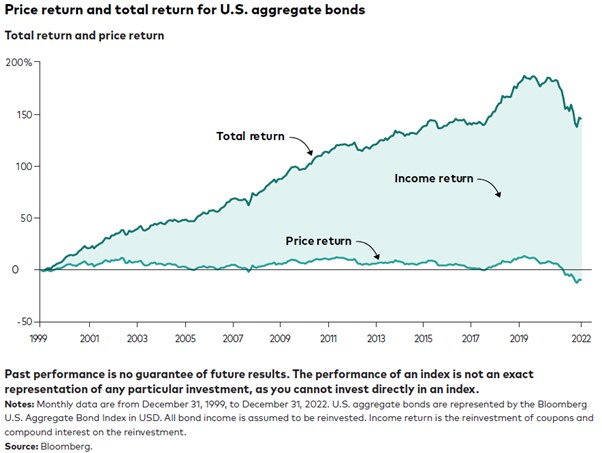

Bond total returns have two components: Price return and income return. The income return includes compounding interest on the coupon payments the bond pays to the investor.

If you are a long-term investor, you should be more focused on the combination of these two return elements rather than just the price element. When interest rates change, these two components move in opposite directions. If interest rates rise (as they did in 2022), the price element falls and the income element goes up because the coupons are now being re-invested at higher interest rates than before. So the price fall is a short-term effect.

The chart below shows that historically the income return element has been the largest part of the return profile of bonds:

Are we in a bond bear market?

The short answer is: it depends.

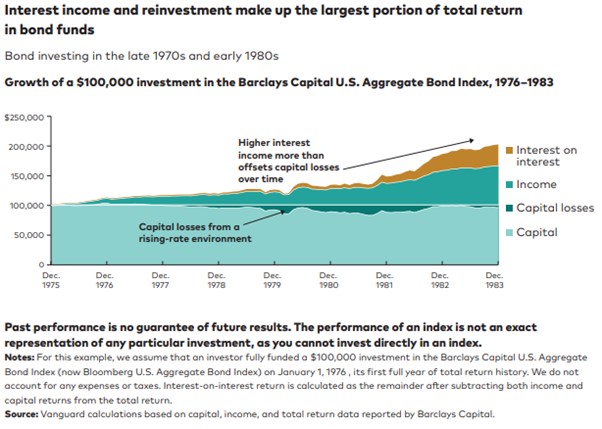

It depends if you need to sell now or if you’re holding for the long term. 2022 was a bear market for bonds. But, a bond bear market is nothing like an equity bear market. This is simply because in equities the price component is by far the more significant element of the total return. If we look at the equity bear market from January 2000 to December 2009, total annualised stock market return inclusive of dividends reinvested (S&P500) was -0.95%. If we instead look at the bond bear market of 1976 to 1983, bond investors nearly doubled their capital despite soaring interest rates and inflation. The chart below illustrates:

As the chart shows, bond returns over time are driven more by the reinvestment rate and the compounding effect than price effects.

See also: Don’t let subconscious biases affect your financial decision making

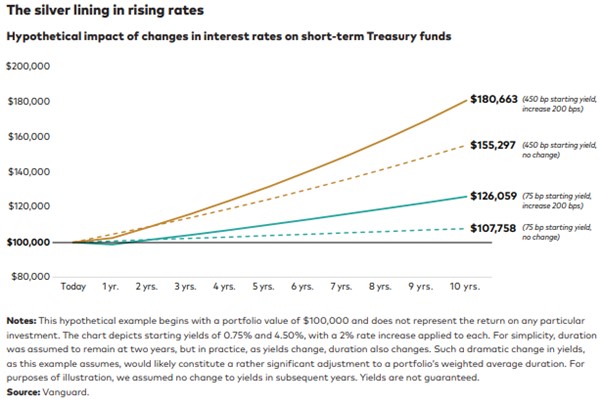

Does the starting interest rate matter when rates rise?

Yes, starting rates do matter. If interest rates are very low when they start to rise, the capital losses will be larger and take longer to break even. Therefore a 2% interest rate rise from a low starting point (such as 0.75%) creates a larger fall in prices than a 2% point interest rate rise from a higher starting point (such as 4.5%). However, the higher interest rates post the rate rise still easily overcome the initial capital losses as interest from the bonds is reinvested at the new higher rates. The chart below demonstrates this principle by showing you where the breakeven point for a 2% rate rise with starting rates of 0.75% and 4.5%

Implications for investors

In the lead-up to the 2022 bond bear market, many of those anticipating a bond market correction used that to sell the idea that the standard balanced 60% equities and 40% fixed income portfolio for long-term investors was in fact dead. They reasoned that a rise in inflation and interest rates would cause equity markets and bond markets to fall at the same time. What was missing from this analysis was the underlying mathematics of long-term bond investing. The argument only holds for traders with very short investment time horizons. Those folk that seek to time the market to make a ‘turn’. The price correction in bonds is far less relevant to the long-term private investor than the short-term trader.

The above should serve as a gentle reminder to those who read of a lot of financial press. Much of what is written is far less relevant to you than you might think!