* Offer limited to first-time clients and applicable to standard service transfers to the UK, SA, EU, USA, AUS, NZ and PL

What our customers say

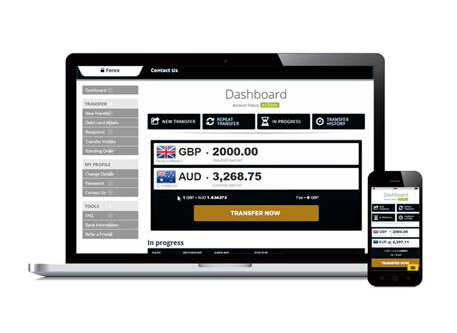

Easy-to-use transfer platform

- Built in currency converter

Exchange rate quotes at your finger tips - Mobile-friendly

Switch between your computer and mobile with ease - Transfer tracking

Easy monitoring for peace of mind

Transfer your money in three simple steps

Sign up

Fill in our short registration form and activate your account with proof of ID

Set up

Log in to request your transfer and pay via internet banking or debit card

Sit back

We'll convert and transfer your funds in 1-3 working days and send you confirmation via text and email

With us, here’s what you get:

Bank-beating exchange rates

We’ve made a business out of beating the banks exchange rates

Low fees & fast transfers

Our rates are great and our fees are small. Funds arrive within 1-3 working days

Online convenience

Load transfers, secure rates and set up rate alerts around the clock

Genuine customer support

Our customers are at the heart of our business

Over 20 years of experience

We’re not a flash in the pan start up, we’ve been moving money for over 20 years

Regulated and transparent

Fully accredited with all relevant regulating bodies with transparent exchange rates

Frequently asked questions about online money transfers

It’s only natural to have questions when you’re choosing a forex provider. Here are the answers to some of the most common questions we receive about our online international money transfer service.

1. How long does it take to activate my account once I’ve registered?

As soon as we have received a copy of your passport and proof of residential address (signed and dated by yourself), we will activate your account on the same business day.

If your transfer exceeds £20,000, we will request a few additional documents.

2. How are your exchange rates determined

To get you the best rates, we canvass the market on your behalf, add a small margin to the rates we obtain and pass that rate on to you. The exchange rates we offer fall between the interbank rate (the truest exchange rate) and the rate offered by high street banks and bureaux de change.

The rates on our site are updated throughout the day, they must be viewed as indicative only.

3. Between which countries can I send funds?

We can transfer funds to just about any worldwide destination. Our most popular destinations are Australia, New Zealand, the UK, Poland, South Africa, Canada, the United States and the Eurozone. If your country is not specifically listed as an option on our website, please give us a call and we’ll help you out with your transfer.

4. What are the transfer fees?

Our fees are dependent on the size and destination of your transfer. Any transfer above £2,000 is automatically processed free of charge. If you are transferring less than £2,000, the table below will provide you with general information on the fees for some of our most popular destinations.

Fees to transfer from the UK

UK to Australia | £2.00 |

UK to Eurozone destination | £5.00 |

UK to New Zealand | £1.00 |

UK to Poland | £0.90 |

UK to South Africa | £10.00 |

UK to UAE, USA and Canada | £10.00 |

Australia to the UK | $5.00 |

Eurozone destinations to the UK | €5.00 |

New Zealand to the UK | $5.00 |

Poland to the UK | zł5.00 |

South Africa to the UK | R250.00 |

5. Can I send money to a credit card?

We can send money to South African credit cards only. At present, we cannot transfer money to Australian, New Zealand or UK credit cards.

6. What is the processing time for a transfer?

Once we have received all the necessary documentation associated with the transaction and your funds have cleared in our client account, the converted funds will be credited to your nominated overseas account within one to three working days.

Register now7. What are the minimum and maximum amounts that can be transferred?

There is no minimum or maximum amount when you transfer money with us. There are, however, certain benefits to sending larger amounts.

8. What methods of payment can I use to transfer the funds to your account?

We accept GBP denominated UK debit card and internet banking payments. Your name and surname must be used as the reference when paying via internet banking. If a name and surname are not supplied, proof of payment must be emailed to us in order for us to allocate your funds for transfer.

9. What happens when I use a debit card as my preferred payment method?

The easiest way to transfer money with us is to use your UK debit card on our website.

First, enter in the amount that you wish to transfer as well as your debit card details. Then enter in the overseas recipient bank account details of the destination to which you wish the money to be transferred. This process is completely under your control and you don’t need to set foot in a bank or log on to an internet banking portal.

As soon as you submit your request online, your money is transferred from your account into ours. As the funds are transferred out of your account, the exchange rate will be secured for your transfer. This is how we ensure the rate you see when you request the transfer is the rate you get.

10. What happens when I use internet banking as my preferred payment method?

If you have chosen internet banking as your preferred payment method, you will need to complete two stages to affect a transfer. Firstly, you will need to upload your transfer instruction onto our website. This tells us the amount of money, destination to which and date on which you want the funds to be sent. After this, you will have to log in to your internet banking account and transfer the requested amount to the relevant Sable International client account, using your name and surname as the payment reference.

The appropriate details for our client holding account will appear when you upload your transfer request on our website.

11. How can I be sure that my funds will be correctly allocated?

If you are using internet banking, it is imperative that you ensure that your funds will clear under your name and surname. If you use your name and surname as the payment reference, we will know that the funds are from you and we can process your transfer as soon as the funds clear.

If the funds will be clearing under a reference other than your own name and surname, please send an email to forex@sableinternational.com, informing us as to what name the funds should clear under. Following these guidelines will decrease the likelihood of a delay.

12. What are the requirements of a registered money service business?

The law requires us to monitor any unusual or suspicious transactions of any size taking place where we have reason to believe the money is derived from illegal activity. We will report any suspicious international money transfers to the authorities.

The law also requires us to keep full records of all transactions, together with copies of identification provided. We are unable to process any transaction where this information is withheld. Proof of address and proof of funds may be required in certain cases – please see our “know your customer” guidelines for more information.

13. How secure is the site?

Our site uses Secure Socket Layer (SSL) 128 bit encryption to protect your transaction details. This 128 bit encryption is the latest and strongest data encryption technique commercially available for securing information between you, our client, and our website.

SSL works by encrypting/scrambling data from our website to your computer. The data is encrypted on our web server and can only be decrypted/unscrambled by the person with the correct decrypt/unscramble key. You can visually verify our site’s use of SSL in two places: The "s" in https in the site’s web address and by the padlock on the left hand side of the address bar.

Send money internationally the easy way.